Billions down the drain as state-run data centers falter

June 04, 2025

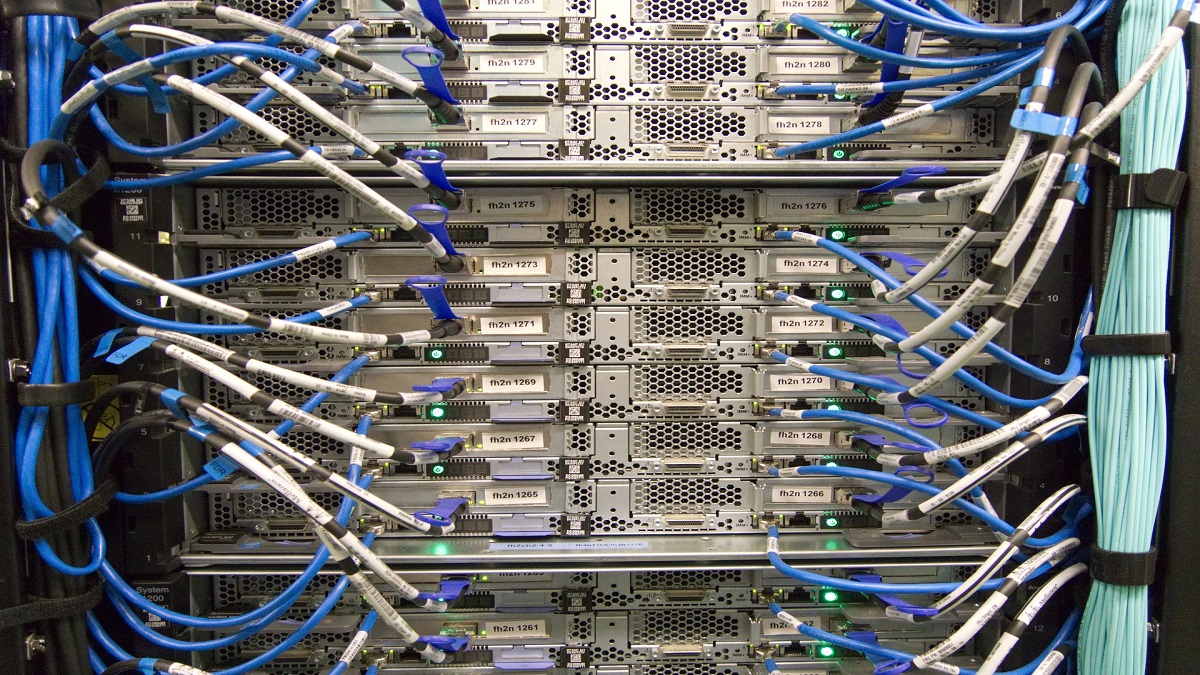

Over the past decade, Bangladesh has seen a rise in private investment in data centers, driven by increasing digital demand across sectors like banking, telecom, and education. Several local companies have developed Tier III and Tier IV facilities, offering secure, scalable storage and cloud services.

These private centers are well-equipped and strategically located to serve growing data needs.

In contrast, publicly funded data center projects have largely failed due to poor planning, outdated technology, and a lack of demand, leading to financial losses. Some foreign investment projects were announced but never materialized, highlighting challenges in execution and investor confidence.

A few promising ventures are underway, but the country still lacks hyperscaler data centers and content delivery networks (CDNs) from major global tech companies.

As a result, Bangladesh depends heavily on foreign bandwidth sources, especially from India. Local hyperscaler infrastructure could cut costs, improve service, and position the country as a regional data hub.

Private investments in data centers

Over the past decade, private investment in data centers has steadily risen with the growing need to store, process, and manage digital data. This demand is largely fueled by the rapid expansion of internet usage and the widespread digital transformation across sectors.

Industry experts said that many organizations, including those in banking, government, healthcare, education, broadband internet services, and other tech-related fields, increasingly rely on data centers and cloud solutions. These facilities support data storage and scalability, streamline operations, and enable digital innovation.

CoLoCity Limited, operating since 2010 in Mohakhali, Dhaka, is Bangladesh’s first Tier III standard carrier-neutral public data center. Following its establishment, other private centers such as NRB Telecom’s Dhaka Colo and Colo Asia also emerged in Dhaka.

To further boost the country’s data infrastructure, Fiber@Home Ltd launched Felicity IDC Limited, which is developing two advanced data centers: one in Hi-Tech City, Kaliakoir, Gazipur, and another in the Software Technology Park, Jashore. The Kaliakoir facility, now fully operational and Tier III certified, houses 250 racks, with another 250 under construction. Upon completion, the Jashore center will offer 660 racks.

Over 20 banks, ISPs, and enterprises securely host their data at the Kaliakoir site. According to Felicity IDC CEO Shariful Alam, the center is purpose-built with an earthquake-resistant design, its own power facilities, and G7-standard equipment from Germany and Japan. It also features robust firewalls and security protocols.

In 2023, DataHub Asia set up a colocation and cloud data center in Thakurgaon. Equipped with 300 racks and backed by an initial investment of Tk 500 million, the center caters to banking, finance, hosting, and manufacturing sectors.

Robi Axiata has invested $13 million in Bangladesh’s first commercial Tier-IV data center, Cypher, at the Software Technology Park in Jashore. Certified by the Uptime Institute for Tier-IV Design, Cypher ensures the highest level of fault tolerance and offers a 99.995% uptime guarantee.

Shahed Alam, chief corporate and regulatory officer at Robi Axiata said that Jashore was chosen strategically due to its lower land costs and the favorable infrastructure provided by the tech park.

“More importantly, Jashore’s low risk of earthquakes and floods minimizes operational disruptions, even during natural disasters,” he noted. Alam added that banks, financial institutions, and other organizations can confidently entrust their data to Cypher, ensuring maximum safety and protection.

Meanwhile, Intercloud Limited, a local company, has invested approximately Tk 500 million to establish a Tier III data center at Bangabandhu Hi-Tech City in Kaliakoir, Gazipur. According to the Bangladesh Hi-Tech Park Authority (BHTPA), construction is nearing completion.

Md Emdadul Hoque, President of the Internet Service Providers Association of Bangladesh (ISPAB), highlighted that while ISPs maintain small-scale data centers for their core routers, they also rent space in larger backup and secondary storage facilities. He noted that renting a single rack costs between Tk 100,000 and 150,000, depending on the center’s infrastructure and sophistication.

Failure of publicly funded data centers in Bangladesh

On November 28, 2019, then-Prime Minister Sheikh Hasina inaugurated the Tier-4 National Data Center in Kaliakoir, Gazipur. Operated by the Bangladesh Data Center Company Limited (BDCCL), the project was funded at a staggering cost of Tk 15.99 billion, including a Tk 11.99 billion loan from China’s Exim Bank. Once hailed as a cornerstone of Bangladesh’s digital transformation, the facility has since become a financial white elephant, failing to attract significant business or usage.

At the time, then-ICT State Minister Zunaid Ahmed Palak—currently imprisoned on charges including murder and corruption—claimed the center would save the government at least Tk 3.53 billion annually by hosting all public data domestically. That promise, however, never materialized.

Faiz Ahmad Taiyeb, special assistant to the Chief Adviser now overseeing the Ministry of Posts, Telecommunications, and ICT, openly admitted, “It was a complete failure. The facility has remained unused, its hardware became obsolete over three years ago, and even refurbishment is futile. We must now scrap everything, including servers, and start from scratch.”

Industry insiders point to poor planning, outdated technology, and weak market demand as central causes of the failure. Conceived under the ‘Digital Bangladesh’ vision, the center was supposed to reduce reliance on foreign cloud services and reinforce data sovereignty. Instead, bureaucratic red tape, a lack of skilled personnel, and underperforming contractors derailed the project, resulting in cost overruns and prolonged neglect.

In a last-ditch effort to salvage the project, BDCCL partnered with GenNext Technologies Limited in 2023 to launch Meghna Cloud—a cloud data infrastructure venture backed by a promised $12.5 million private investment. GenNext was expected to supply servers, storage, and networking equipment.

However, following the fall of the previous government, GenNext’s top executives and investors reportedly fled the country. The company was linked to Saida Muna Tasneem, Bangladesh’s former High Commissioner to the UK, with her husband and children allegedly involved in the venture.

The deal was widely criticized for being one-sided, with GenNext receiving 74% of potential profits.

The company later transferred its ownership to a firm with no prior data center experience, further complicating the project, said Mr. Taiyeb.

Another major setback came through an $18 million direct purchase deal with Oracle in December 2021. The agreement aimed to deploy Oracle’s Dedicated Region Cloud Customer (DRCC) platform at the Kaliakoir center, allowing secure local hosting of government data.

Due to BDCCL’s persistent mismanagement and delays, the system was never made operational. Consequently, sensitive data from 34,000 government offices had to be migrated to Oracle’s Singapore-based cloud, undermining national data sovereignty and incurring substantial foreign exchange costs. Despite full payment, the infrastructure remained underutilized and insecure.

Another public project—the Bangladesh Computer Council’s Tier-III certified data center, built in 2011 at a cost exceeding Tk 2.5 billion—also failed to deliver due to operational inefficiencies.

Announcements that never materialized

Despite high-profile announcements amounting to nearly Tk 50 billion in foreign investment for Bangladesh’s data center sector, most projects failed to take off. Former ICT State Minister Zunaid Ahmed Palak took heavy media limelight with these announcements, but the majority never progressed beyond initial publicity.

Yotta Data Services, a subsidiary of Indian conglomerate Hiranandani Group, had announced an ambitious Tk 20 billion investment to build a Tier IV data center at Bangabandhu Hi-Tech City. Although some preliminary construction began in 2023 following a land allotment, the company ultimately backed out.

“The land allotment to Yotta has been revoked as they failed to commence full-scale construction,” said Rokibul Hasan, assistant director at the Bangladesh Hi-Tech Park Authority.

Similarly, DataVolt, a major Saudi Arabian data center and power generation company, announced a $100 million investment in 2023 to establish a state-of-the-art data center in Bangladesh. However, the project stalled completely—DataVolt did not even acquire the allotted land.

One project, however, shows signs of real progress. A Tier IV data center is currently under development in Kaliakair Hi-Tech Park with a foreign investment of $200 million. The project is led by Jatra International and backed by the U.S.-based Osiris Group.

“They have completed the initial construction and design phase. Currently, they are appointing construction contractors to begin the main building work,” Hasan said.

Hyperscalers and CDNs necessary for digital sovereignty

Bangladesh remains heavily dependent on third countries for data delivery and internet bandwidth due to the absence of hyperscaler data centers and content delivery networks (CDNs) within its borders.

Hyperscaler data centers—massive facilities operated by global tech giants such as Amazon, Microsoft, Google, and Meta—are designed to handle enormous volumes of data and computing power.

CDNs rely on a distributed network of servers that cache and deliver content closer to users, improving speed and reducing latency.

Most of the data consumed by Bangladeshi users originates from companies like Meta, Google, Akamai, and Amazon. Yet, none of these companies currently maintains data centers or CDN points of presence (PoPs) in Bangladesh. Instead, their nearest PoPs are located in Indian cities like Kolkata, Chennai, and Mumbai, while Singapore continues to serve as Asia’s regional data hub. As a result, Bangladesh remains reliant on foreign nations for the bulk of its bandwidth needs.

Currently, the country’s bandwidth demand stands at approximately 6,600 Gbps. Of this, around 45% is supplied by Bangladesh Submarine Cables PLC (BSCPLC) via Singapore. The remainder—about 3,700 Gbps—is imported from India through terrestrial cables, costing the country an estimated $50 million annually.

“As companies like Google, Facebook, and Akamai do not have data centers in Bangladesh, their cached bandwidth must be imported from India,” said Md Ariful Haq, deputy general manager of marketing and sales at BSCPLC.

“If these companies established local data centers, the same level of service could be delivered using only 370 Gbps of submarine bandwidth—dramatically reducing our foreign dependence.”

Establishing a hyperscaler facility in Bangladesh could significantly reduce foreign currency outflow, curb bandwidth imports, and transform the country into a regional data hub for South Asia. Bangladesh could potentially supply bandwidth to India’s northeastern states, Nepal, Bhutan, and parts of Myanmar.

The under-construction Tier-IV data center by Jatra International, backed by U.S. investment, could help pave the way. Moreover, enacting an intermediary liability law that is favorable to global tech giants like Meta and Google may encourage them to invest in local infrastructure and CDNs.

In an era where data is often described as the ‘new oil,’ ensuring its security and efficient management is important. Despite its growing digital footprint and substantial investments in data centers, Bangladesh continues to rely heavily on foreign servers for data storage and processing.

This dependence raises national security, economic sustainability, and digital sovereignty concerns. Establishing local data centers could be a game-changer for the nation, enhancing efficiency, reducing costs, and opening doors for new investments and job opportunities.

Mahmudul Hasan is a seasoned journalist who extensively covers telecom, IT, and IT-enabled services sectors with in-depth information and analysis.

Most Read

Electronic Health Records: Journey towards health 2.0

Making an investment-friendly Bangladesh

Understanding the model for success for economic zones

Bangladesh facing a strategic test

Bangladesh’s case for metallurgical expansion

How a quiet sector moves nations

A raw material heaven missing the export train

Automation can transform Bangladesh’s health sector

A call for a new age of AI and computing

You May Also Like