Bangladesh facing a strategic test

August 09, 2025

Bangladesh’s business environment is undergoing a phase of transition, impacted by both geopolitical shifts and domestic political changes. Following the change in government in August last year, the country’s industrial sector faced significant disruptions, particularly in the ready-made garment (RMG) sector.

Just as the situation began to stabilize, a fresh challenge has emerged: U.S. reciprocal tariffs. The Trump administration has imposed a 35% (revised from the initial 37%, as of July 20) additional duty on all goods from Bangladesh.

The development has raised concerns among RMG exporters, as the sector forms the backbone of the national economy. The U.S. is also Bangladesh’s single largest export destination.

Compounding the pressure, Bangladesh is in the midst of a complex transition from its current status as the least developed country (LDC) to that of a developing nation.

Business leaders and exporters are urging the government to address the tariff issue with urgency and develop a comprehensive response plan. They emphasize that any policy decisions must align with Bangladesh’s economic capacity, prevailing global trade dynamics, and the current geopolitical landscape.

Some have also urged the government to seek a two- to three-year extension of the LDC graduation deadline, allowing industries more time to adapt.

Government policymakers say they are already in discussions with business groups, economists, and other stakeholders to determine the best course of action regarding the U.S. tariff.

However, officials emphasize that there is no scope to delay the graduation. Instead, the current priority should be building resilience among exporters.

A new socioeconomic landscape

In July and August 2024, Bangladesh experienced a significant political shift. The aftermath of the turmoil rippled through the economy, triggering widespread labor unrest across key sectors, most notably in the RMG industry.

Mahmud Hasan Khan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) and managing director (MD) of Rising Fashions Ltd, told Industry Insider, “The kind of symptoms that usually follow an uprising were visible here as well. In particular, there was a major deterioration in law and order.”

“Mob culture was widespread at the time, but that has largely declined,” he said, adding, “Worker unrest and other security-related issues have also eased, though the overall situation still requires further improvement.”

However, new concerns are emerging, particularly a rising fear of extortion among business owners.

Three officials from two export-oriented companies, who spoke on condition of anonymity, said extortion had declined significantly after August last year, but has now increased again.

They also reported that new extortionist groups linked to certain political parties have recently been formed.

Exports maintain upward momentum

Despite facing several challenges, Bangladesh’s exports, especially RMG shipments, have maintained a positive trend.

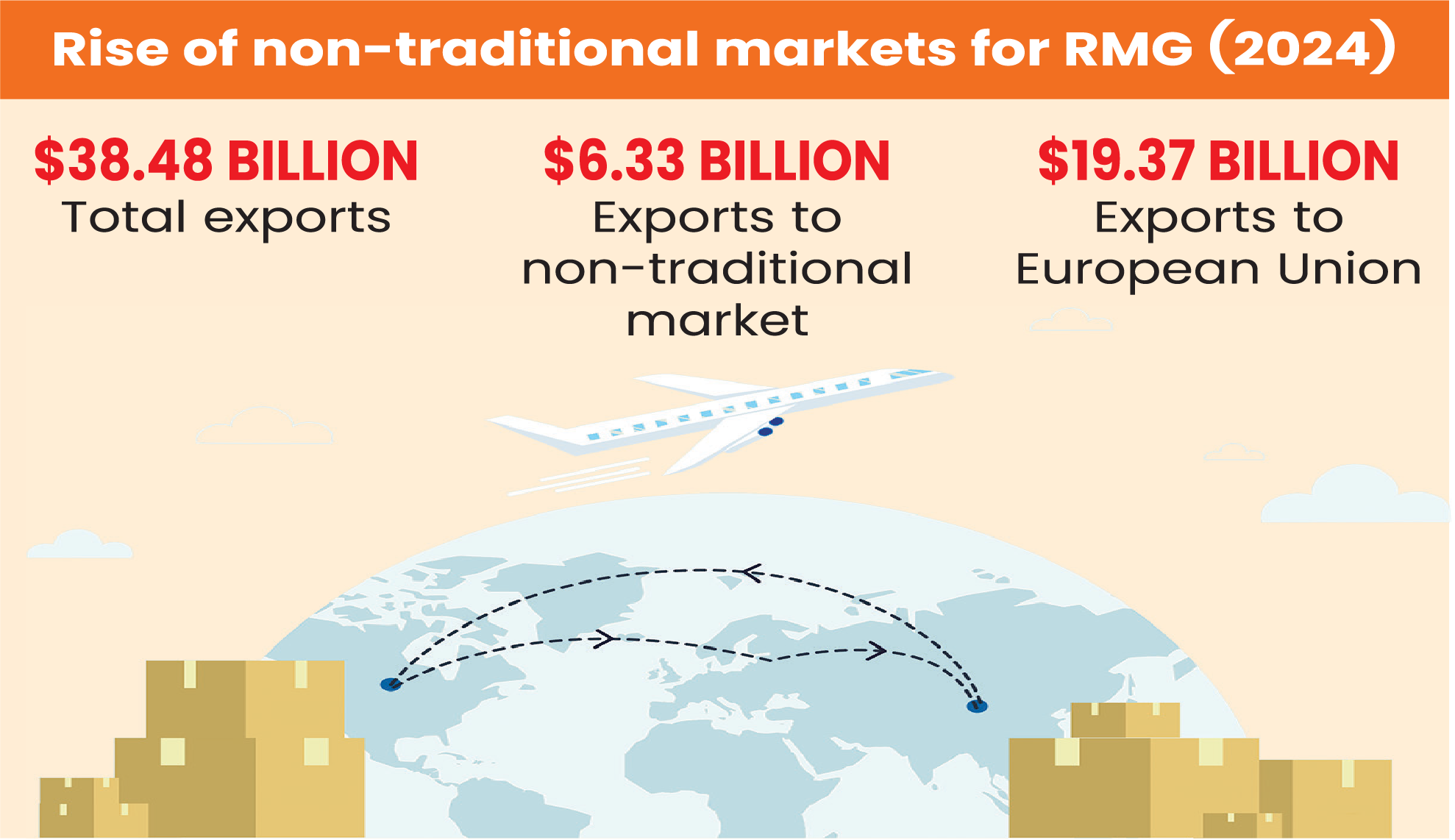

According to the latest data from the Export Promotion Bureau (EPB), the country exported RMG worth $39.34 billion in the last (July–June) fiscal year (2024-25).

This marks an 8.84 percent increase compared to the same period of the 2023–24 fiscal year. Export growth was seen across all key markets, including the European Union (EU), the United States (U.S.), the United Kingdom (UK), and Canada.

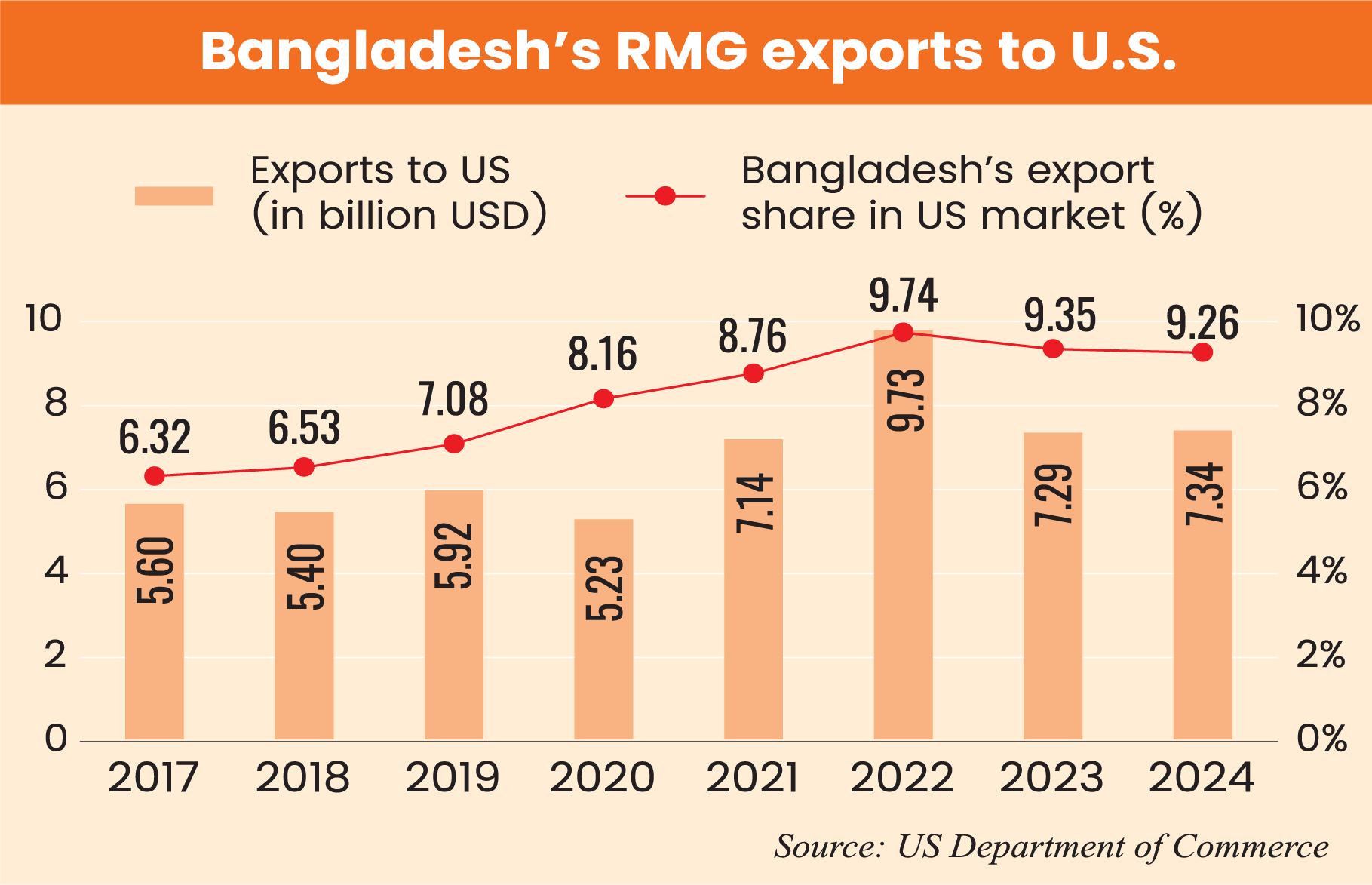

From July 2024 to June 2025, Bangladesh exported $8.69 billion worth of goods to the United States. This made up 18% of the country’s total exports.

Of this amount, ready-made garments, comprising both woven clothes ($4.95 billion) and knitwear ($2.60 billion), accounted for a combined total of $7.55 billion. This shows how important the U.S. market is, especially for woven garments.

But with the U.S. now imposing a 35% tariff, this heavy reliance could hurt Bangladesh’s RMG sector. Exports also grew across all of Bangladesh’s top 10 markets, including the U.S.

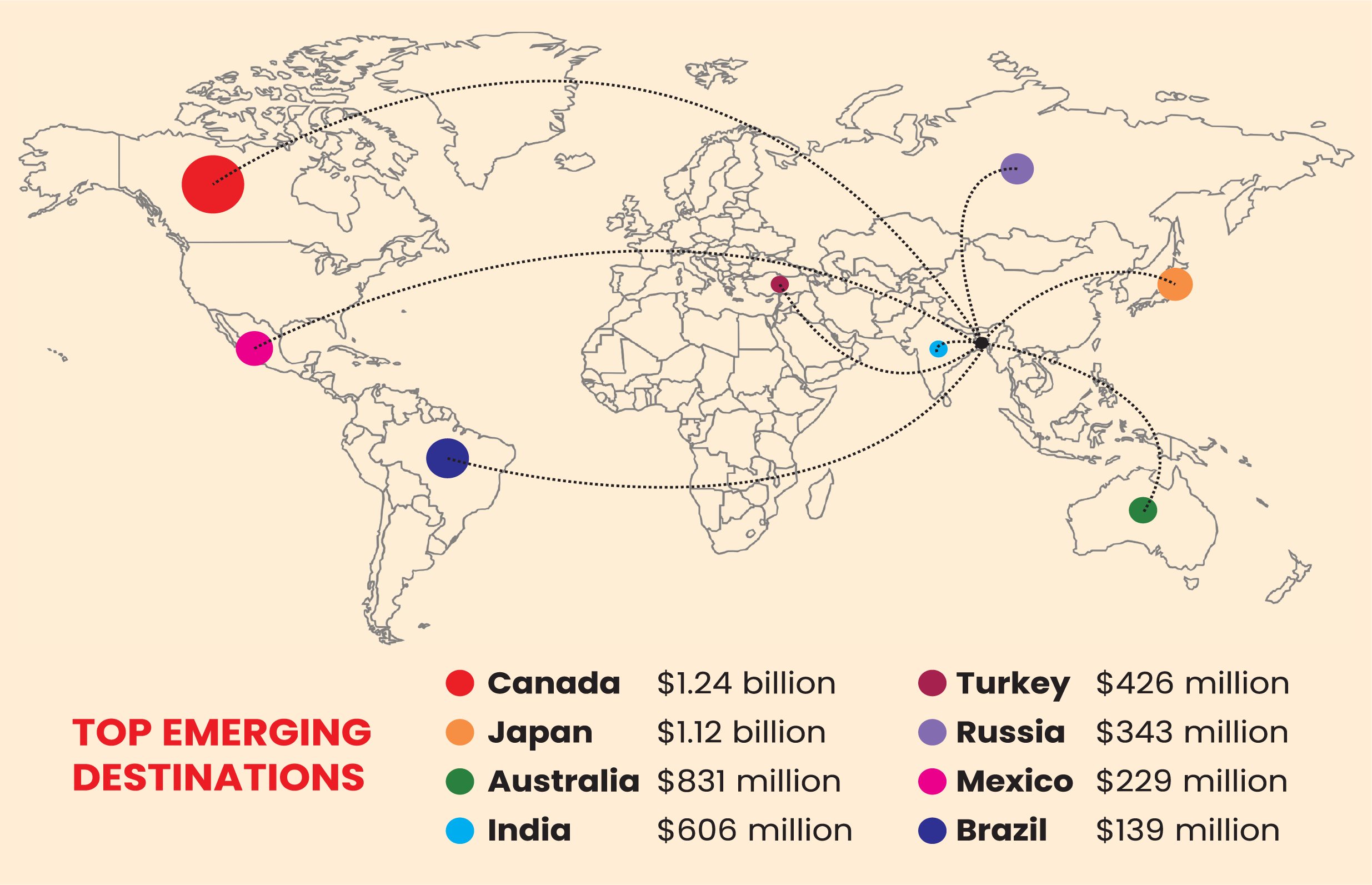

Notably, shipments to non-traditional and emerging markets have also seen growth. Japan, Australia, Russia, India, and South Korea are emerging as the top five new export destinations for Bangladesh’s ready-made garments.

Exports to Japan and India have seen the highest growth. However, shipments to Russia and South Korea have declined during the same period.

Md. Mohiuddin Rubel, former BGMEA director and current managing director of Bangladesh Apparel Exchange, as well as additional managing director of Denim Expert Limited, stated that the situation has improved significantly since August 5.

However, the export flow remains below expectations, mainly due to global factors such as U.S. reciprocal tariffs and ongoing conflicts in the Middle East.

He noted that long-term orders are particularly low, with buyers opting for short-term orders amid uncertainty over the outcome of the Trump tariffs.

The blow of retaliatory tariffs

As businesses were adapting to the country’s new political and economic situation, the Trump administration announced global reciprocal tariffs on April 3, including those on Bangladesh. Initially, a 37 percent duty was imposed, which was later revised to 35 percent following negotiations. The new tariff rate is scheduled to take effect on August 1, 2025.

Following the U.S. announcement of additional tariffs in April, Bangladesh initiated discussions with the U.S. to seek a reduction in these tariffs. Professor Muhammad Yunus, Chief Adviser of the interim government, sent a letter to U.S. President Donald Trump, requesting a suspension of the decision.

At one point, the U.S. suspended the tariff hike for 90 days, during which negotiations continued. However, midway through the talks, Trump announced a new round of additional tariffs on products from several countries, including Bangladesh.

Most recently, the two countries held a three-day round of discussions on tariff exemptions starting on July 9.

Several issues remain unresolved: both parties failed to reach an agreement on key points. Another round of negotiations will be held.

However, both sides agreed to hold inter-ministerial consultations within their respective governments before resuming formal talks between their delegations. Until the next announcement, the 35 percent tariff will remain in effect.

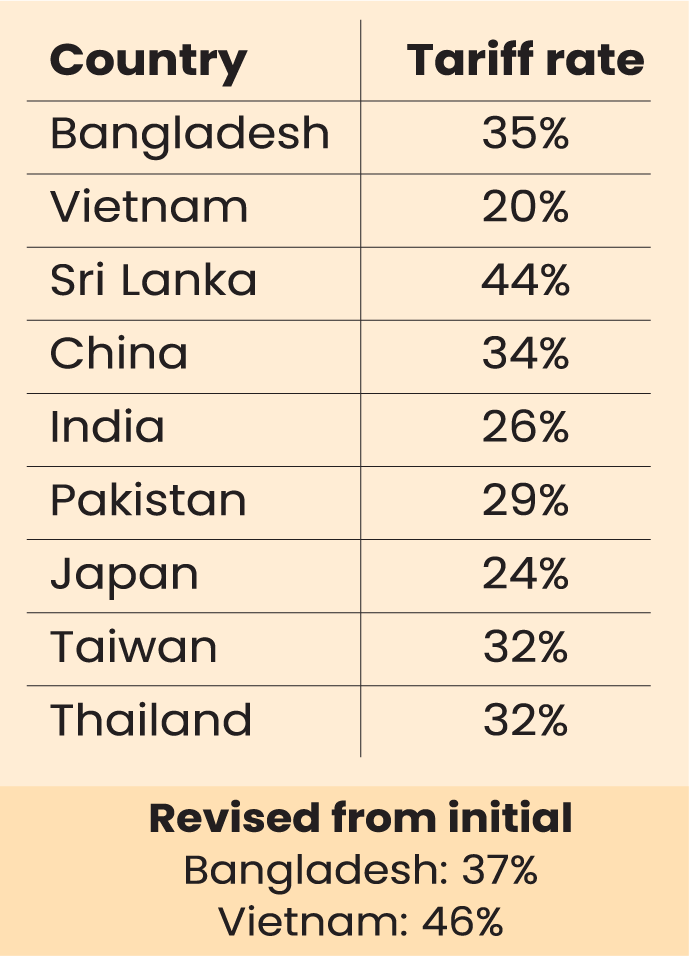

Among competing countries, the U.S. initially announced retaliatory tariffs in April: 26 percent for India, 29 percent for Pakistan, 46 percent for Vietnam, 49 percent for Cambodia, and the highest, 145 percent for China.

Later, under the Trump 2.0 tariff announcement, some countries managed to reduce their rates through negotiations.

Vietnam brought its tariff down from 46 percent to 20 percent, Cambodia from 49 percent to 36 percent, and Indonesia from 32 percent to 19 percent. Revised tariff rates for India and Pakistan are expected to be around 20 percent.

In contrast, Bangladesh has managed to reduce its tariff by only two percentage points.

Bangladesh usually pays an average tariff of 15 percent on goods exported to the U.S.. The revised reciprocal tariff of 35 percent effectively increases the rate to around 50 percent.

Mohiuddin Rubel, former BGMEA director, said the tariffs have already started impacting the U.S. market. Brands are now selling products sourced from Bangladesh at higher prices than before, though the final impact remains uncertain.

“If tariffs remain high, competitor countries will benefit, and we will fall behind. As a result, our exports will suffer,” he said.

Exporters say a 35% tariff is significantly higher than those of the competitor countries.

He emphasized that Bangladesh must negotiate to prevent tariffs from reaching a level that is harmful.

“35% tariff is still very high, especially compared with competitor countries. If tariffs stay at such a high rate, buyers will expect us to absorb the costs. They will seek lower prices elsewhere if we cannot meet their demands,” he added.

M Masrur Reaz, a Bangladeshi economist and chairman and CEO of Policy Exchange Bangladesh, a private think tank, said the country appeared unprepared when the retaliatory tariffs were first announced in April.

“However, over the past three and a half months, we’ve seen several proactive steps and discussions with the American side. But to this day, the outcome remains very pessimistic,” he told the Industry Insider.

In April, a Bangladeshi delegation held its first meeting with the Office of the U.S. Trade Representative (USTR). Following that, the U.S. side raised six or seven key issues, including tariff concerns.

Other topics included the investment climate, intellectual property rights, and non-tariff barriers in the financial sector. Bangladesh has since provided responses, which Reaz termed a positive development.

Strategic test for Bangladesh

Fazle Shamim Ehsan, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said the real concern surrounding the potential U.S. tariffs lies not in Bangladesh’s position, but in how competing countries respond.

“If Bangladesh can secure similar or nearest U.S. tariff rates as Vietnam, India, or Pakistan have, I don’t see much of a challenge. But finally, if those countries gain preferential access and we don’t, we’ll be at a serious disadvantage. In that case, staying competitive will be nearly impossible,” he said.

Bangladesh must be prepared for a range of possible outcomes in the face of growing trade tensions, experts and economists have said.

Dr. M. A. Razzaque, chairman of the Research and Policy Integration for Development (RAPID), noted that focusing on a single scenario would be a mistake.

“We must also consider what happens if a 35% tariff remains in place,” he said, adding, “In that case, exporters will need to negotiate with buyers and make it clear that it’s neither fair nor feasible for them to bear the full burden of additional tariffs alone.”

Some suggest that Bangladesh might consider exploring the possibility of increasing exports to other countries or regions. But many business leaders remain skeptical about that. They argue that there isn’t much scope for developing entirely new export markets.

Mr. Fazle Shamim Ehsan explained, “No other country has purchasing capacity like that of the EU and the U.S. As a single country, the U.S. has the largest purchasing power in the world. You can’t compare it to anything else. That’s why even China and India are showing flexibility. Yes, we can explore other markets, but they cannot serve as alternatives to the U.S. or EU.”

Some pointed to another missed opportunity: the shifting of RMG orders from China to other countries. Bangladesh has not fully capitalized on this shift. Experts attribute the reasons to the country’s inadequate infrastructure, energy shortages, and broader logistical challenges. Additionally, foreign investors remain concerned about the absence of a stable political government.

Government efforts

The government is continuing negotiations with the U.S. over Trump’s reciprocal tariffs, though much of the process is being kept confidential. Meanwhile, Bangladesh is proactively working to increase its bilateral trade balance with the country.

To encourage a reduction in tariff rates, the government is arranging the import of 300,000 tons of wheat at premium prices through government-to-government (G2G) deals.

The Ministry of Civil Aviation and Tourism is also taking steps to purchase aircraft from the U.S.-based Boeing Company. The government is also easing procedures for cotton imports from the U.S.

According to sources at the Ministry of Commerce, the USTR has already sent a draft trade agreement to Bangladesh. However, the draft includes conditions that have raised concerns in Dhaka.

Notably, the agreement would bar Bangladesh from trading with countries currently under U.S. sanctions or those that might be sanctioned in the future. There are also other geopolitical trade issues.

Mahmud Hasan Khan, president of the BGMEA, stated that the industry is aware of the government’s efforts; however, the whole picture remains unclear to the industry. From the beginning, the government has totally ignored the business community.

“We’ll try to get more clarity by speaking to high-level officials. If there’s any input required from our side, we’ll certainly provide it,” he said.

Commerce Secretary Mahbubur Rahman, a key member of the negotiation team, stated that Bangladesh will remain within the established framework of the World Trade Organization (WTO).

“We won’t do anything outside the WTO structure. If any conditions appear unacceptable, we are unlikely to accept them,” he added.

No singular solution

Economist Masrur Reaz thinks that reciprocal tariffs cannot be addressed solely through tariff concessions for two key reasons.

First, if Bangladesh offers tariff reductions, it must extend them to all trading partners under the WTO’s Most Favoured Nation (MFN) obligations. Otherwise, the country risks breaching WTO rules, which could lead to further complications.

Secondly, the United States has specific economic and political interests that Bangladesh needs to consider. Washington is keen to expand exports of certain products to Bangladesh, such as U.S. cotton, soybeans, and various technological and mechanical goods.

Mr. Reaz noted that Bangladesh should focus on facilitating those imports and incentivising the private sector accordingly.

Masrur Reaz also identified several key sectors where Bangladesh can deepen engagement with the U.S. Infrastructure improvements, particularly in warehousing, are crucial for U.S. cotton exporters.

Reaz pointed to growing American interest in the digital economy and highlighted oil and gas as another strategic area for cooperation.

“The government,” he said, “should accelerate onshore and offshore gas exploration and welcome U.S. investment. Similarly, Bangladesh’s aviation sector, with Biman’s fleet already dominated by Boeing aircraft, could benefit from closer collaboration with the U.S. manufacturer.”

“This is not just a commercial or trade matter, it’s a political one,” Mr Reaz said, adding, “Bangladesh must build a strong diplomatic and strategic relationship with the Trump administration and broader U.S. leadership.”

Concerns over trade benefits intensify

Bangladesh is preparing to graduate from the category of Least Developed Countries (LDCs) by 2026. However, concerns are mounting over the potential loss of key trade privileges that have supported the country’s export-led growth for decades.

This issue adds to existing worries over reciprocal tariffs from the U.S., creating a dual challenge for policymakers and exporters.

Dr. M. A. Razzaque, chairman of RAPID, said the transition will bring significant changes.

“Once we graduate from LDC status, many export markets will start imposing tariffs that we previously didn’t have to pay. This could lead to a loss of market access,” he warned.

Currently, as an LDC, Bangladesh enjoys duty-free and quota-free (DFQF) access to markets such as the European Union, Canada, Japan, Australia, and India. These benefits are expected to be withdrawn or made conditional after graduation.

The EU’s GSP+ scheme could be a potential alternative, but it comes with stringent conditions related to human rights, labour rights, environmental protection, and governance.

Under WTO rules, Bangladesh will no longer be allowed to provide export subsidies as a developing country. The country will also lose access to concessional loans and exemptions under intellectual property rights (IPR).

At the same time, compliance requirements for global standards will become more stringent. To qualify for schemes like GSP+, Bangladesh must demonstrate strong adherence to international standards on human rights, labour rights, environmental sustainability, and governance.

Among Bangladesh’s DFQF partners, only the United Kingdom has so far confirmed that it will continue offering the facility after LDC graduation.

Negotiations with the European Union are still ongoing. The EU has agreed to extend specific preferences until 2029, but after that, Bangladesh will need to qualify for GSP+ status through further negotiations.

The question is, can Bangladesh’s RMG qualify for GSP+ benefits?

Any sector that constitutes a dominant share of a country’s exports can be excluded from GSP+ under a provision known as the ‘safeguard clause.’ Given the volume of Bangladesh’s garment exports to Europe, the sector is likely to fall under that clause.

Delay LDC graduation? Government says no

Business leaders have urged the government to delay Bangladesh’s graduation from LDC status or extend the post-graduation grace period. However, government officials and economists say such a move is no longer possible.

The executive president of BKMEA, Fazle Shamim Ehsan, said, “Our demand is to postpone the LDC graduation by another three years; that would be the most beneficial for us. But if that’s not possible, then the government should initiate a fresh round of negotiations.”

“We should work with our key export partners—those offering preferential duty access—to extend the grace period from three to six years. It’s high time we started taking steps in that direction,” he added.

Speaking at a recent seminar organized by RAPID, Planning Advisor Dr. Wahiduddin Mahmud said, “I haven’t seen any country facing major setbacks after exiting LDC status. There’s no need to dwell on it excessively. Instead, we should focus on preparing for the transition.”

At the same event, former BGMEA president Rubana Huq offered a different view. “We have entered the LDC graduation process without adequate preparation. Frankly, we are not ready,” she remarked.

Economist M. A. Razzaque raised concerns about the garment sector’s access to GSP benefits in the post-LDC era.

“If the RMG sector fails to qualify for GSP after graduation, how much of our export advantage will remain?” he questioned.

“That’s why we must begin discussions and negotiations with the European Union immediately. The current EU GSP scheme remains valid until 2027. This is our window of opportunity. We must use this time to convince the EU to exempt Bangladesh from the safeguard clause.”

The interim government has adopted a strategic framework known as the Smooth Transition Strategy (STS). The move follows a UN General Assembly resolution that recommends countries graduating from LDC status adopt and implement such strategies to ensure a stable and sustainable transition.

Economists, however, caution that an action plan alone will not be enough. Structural issues, especially within the fiscal and administrative frameworks, continue to hamper preparation.

On the other hand, revenue shortfall is a major concern. A significant portion of government revenue continues to come from international trade taxes, with a substantial portion allocated to debt repayment.

This has made the economy increasingly reliant on external borrowing. With the looming threat of U.S. retaliatory tariffs on one side and post-graduation policy shifts on the other, the country faces a dual challenge.

“We’re stuck in a kind of trade trap,” said Professor Razzaque.

“If Bangladesh signs trade deals that lower tariffs, it risks cutting into a key source of government revenue. However, at the same time, geopolitical realities are pushing us toward FTAs, including those with the U.S. You can’t reasonably enter such negotiations while keeping tariff rates high.”

“A more practical approach would be to first rationalize tariffs—lower them in a structured, logical way—and then proceed with trade agreements.”

“But we’re yet to see a clear strategy from the government on this,” he added.

Shafiqul Islam is a business journalist and contributing writer. He specializes in small business enterprises, startups, investment, credit, sustainability, recycling businesses, and trade bodies.

Most Read

Electronic Health Records: Journey towards health 2.0

Making an investment-friendly Bangladesh

Understanding the model for success for economic zones

Bangladesh facing a strategic test

Bangladesh’s case for metallurgical expansion

How a quiet sector moves nations

A raw material heaven missing the export train

Automation can transform Bangladesh’s health sector

A call for a new age of AI and computing

You May Also Like