Bangladesh walking toward a market-determined exchange rate regime

BY Rassiq Aziz Kabir and Iftekharul Islam

May 09, 2025

Bangladesh’s foreign exchange situation has seen dramatic shifts and policy debates in recent years. Recent developments indicate signs of stabilization after a steep 40% depreciation of BDT over the last three years. However, the transition toward a fully market‑determined exchange rate system has multifaceted challenges.

A decade of volatility

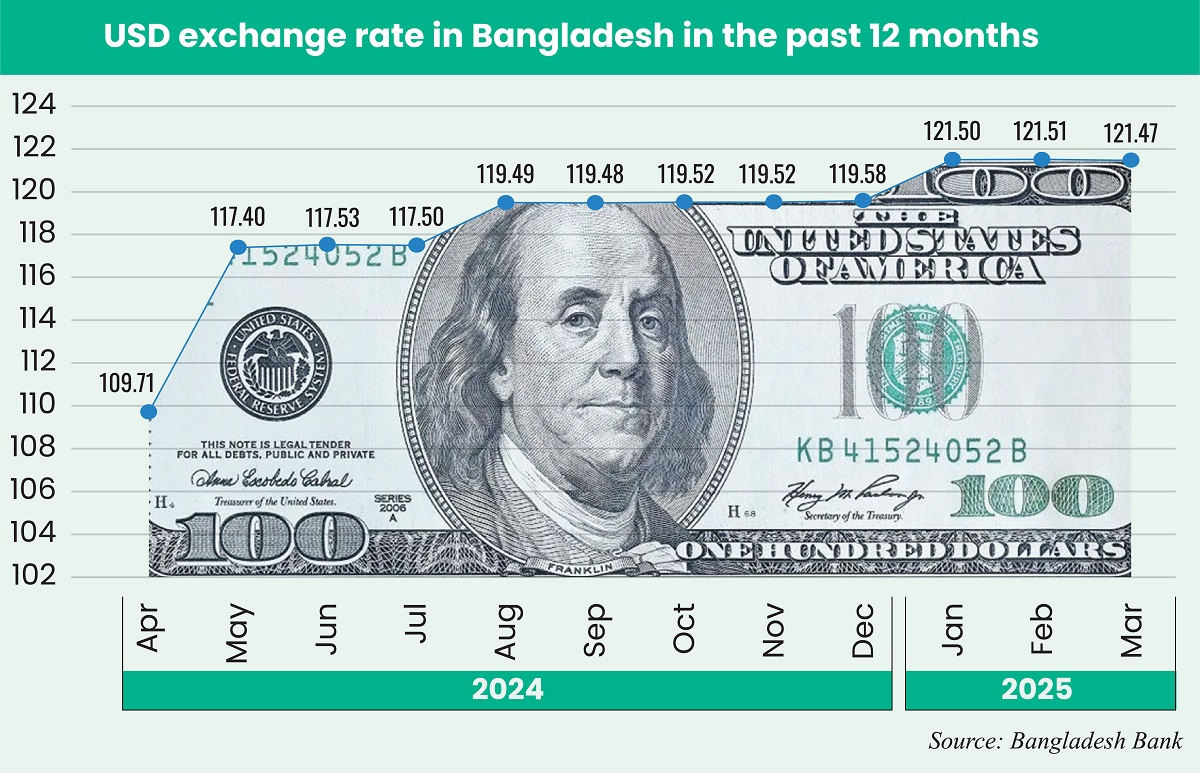

In early 2024, the BDT traded at an average of 109.5 per US dollar in March and April. A sharp adjustment followed in May 2024, when the rate spiked to 116.9 BDT/USD, which set the stage for Bangladesh Bank’s crawling peg regime.

By June and July 2024, the rate stabilized at around 117 BDT/USD. Subsequently, from August through December 2024, the rate hovered at 119 takas against a dollar before beginning an upward trend in early 2025 (January: 121.9, February: 121, and March: 121.56).

The crawling peg system introduced in May 2024 as an interim measure has to provide a controlled transition from a highly managed regime to a more market‑oriented one. The latest study by the Center for Policy Dialogue (CPD) and Independent Review of Bangladesh’s Development (IRBD) noted that the Taka appears to be reaching an equilibrium level after a severe decline over the previous three years.

The report also emphasized that a fully market‑determined regime is on the horizon and that current incentives given to remitters (roughly USD 0.67 billion in 2024) should be reassessed in light of revenue constraints.

Reform efforts

Following the political upheaval in August 2024, the transitional period has ushered in a series of reforms. In December 2024, discussions between the Bangladesh Bank (BB) and the International Monetary Fund (IMF) led to recommendations to amend the Bangladesh Bank Order. The IMF urged that price stability be elevated as the central bank’s primary objective while enhancing its autonomy and shifting from a reserve money‑targeting framework to an interest rate‑based policy regime.

Further reinforcing this direction, BB Governor Ahsan H. Mansur stressed a pragmatic approach to determining the exchange rate. “The central bank will not allow the country’s exchange rate to be dictated by Dubai or any other external market,” he declared, emphasizing that the Taka’s value would be set according to domestic economic needs rather than external speculation.

Fighting inflation and banking woes

Despite recent stabilization, inflation remains stubbornly high. Throughout late 2024, it hovered between 9 and 10 percent. Policymakers expect it to gradually decline to an annual rate of 7–8 percent by the end of 2025.

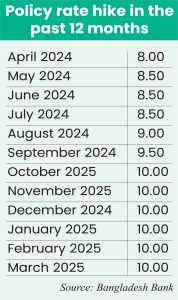

Nevertheless, tighter monetary policies, such as the recent hikes that took the policy rate to 10 percent, have also slowed down the economy while curbing inflation. These contractionary measures come at the cost of higher borrowing rates, which are particularly challenging for small and medium enterprises (SMEs) and could stifle private investment.

Foreign exchange reserves have shown a modest recovery (around USD 20 billion). This level covers only about three months of imports. Persistent trade deficits, driven by high import bills (especially for energy) and challenges in the export sector, continue to exert pressure on the Taka.

The trade balance remains under strain despite improvements in net foreign assets (NFA) due to better remittance flows and export growth.

The country’s net foreign assets had dipped sharply before showing signs of recovery, partly thanks to higher remittances and export growth. However, fiscal tightening remains a priority, with efforts underway to reduce government debt and increase tax revenue in line with IMF conditions.

In addition, the banking sector has suffered from years of mismanagement and politically influenced lending practices. The interim government has initiated reforms by replacing boards at vulnerable banks and tightening regulatory oversight.

Yet, excess market liquidity and high short-term interest rates have been cited as factors that limit banks’ ability to extend credit. While painful, the BB governor reaffirmed that these measures are necessary to restore discipline in the sector and ensure that the exchange rate is determined by sound economic fundamentals rather than market distortions.

Toward a market-based regime

Several policy prescriptions emerge from the current scenario. First and foremost is the need to transition to a fully market-determined exchange rate regime gradually. While the crawling peg system has delivered short-term stability, shifting toward a freely floating rate will better reflect underlying supply and demand dynamics. Although initial volatility may occur, a market-based system would eventually offer greater transparency and efficiency.

Strengthening the governance frameworks within banks and increasing transparency in policy operations will help restore investor confidence. The central bank must be made fully autonomous.

Monetary reforms must accompany complementary fiscal and supply‑side measures. Given that persistent inflation is partly driven by external price pressures and domestic supply chain inefficiencies, the government should check public expenditures, modernize the tax system, and invest in logistics and infrastructure.

Targeted support for vulnerable sectors, particularly SMEs, which are currently struggling with high borrowing costs, is essential. Subsidized credit facilities or specially designed loan programs can mitigate the adverse impacts of a contractionary monetary policy on these critical segments.

Overall, everything depends on the success of the interim government’s reform efforts. Rightly thought-out measures can finally bring the much-desired exchange rate stability. While the process might be painful, the results will benefit the nation in the long term.

Rassiq Aziz Kabir is a policy analyst currently working as a research associate at the Research and Policy Integration for Development (RAPID). He formerly worked as a program associate in the Centre for Policy Dialogue (CPD) research division.

Iftekharul Islam is currently working as a policy researcher for the South Asian Network on Economic Modeling (SANEM). Prior to joining SANEM, Iftekhar worked as a Programme Associate (Research) at the Centre for Policy Dialogue (CPD), interned at the Bangladesh Bank, and Research and Policy Integration for Development (RAPID).

Tags:

Most Read

Electronic Health Records: Journey towards health 2.0

Making an investment-friendly Bangladesh

Bangladesh facing a strategic test

Understanding the model for success for economic zones

Bangladesh’s case for metallurgical expansion

How a quiet sector moves nations

A raw material heaven missing the export train

Automation can transform Bangladesh’s health sector

A call for a new age of AI and computing

You May Also Like