Local cosmetics brands gaining ground

August 08, 2025

The local cosmetics industry in Bangladesh is increasingly capturing a market that was once dominated by imports. Through the expansion of product lines, quality improvements, and competitive pricing strategies, domestic manufacturers are gaining the upper hand.

Once, it was the norm for returning travelers to be asked to bring toiletries such as soap, shampoo, and creams. The reason was limited availability and a lack of consumer trust in locally produced personal care items.

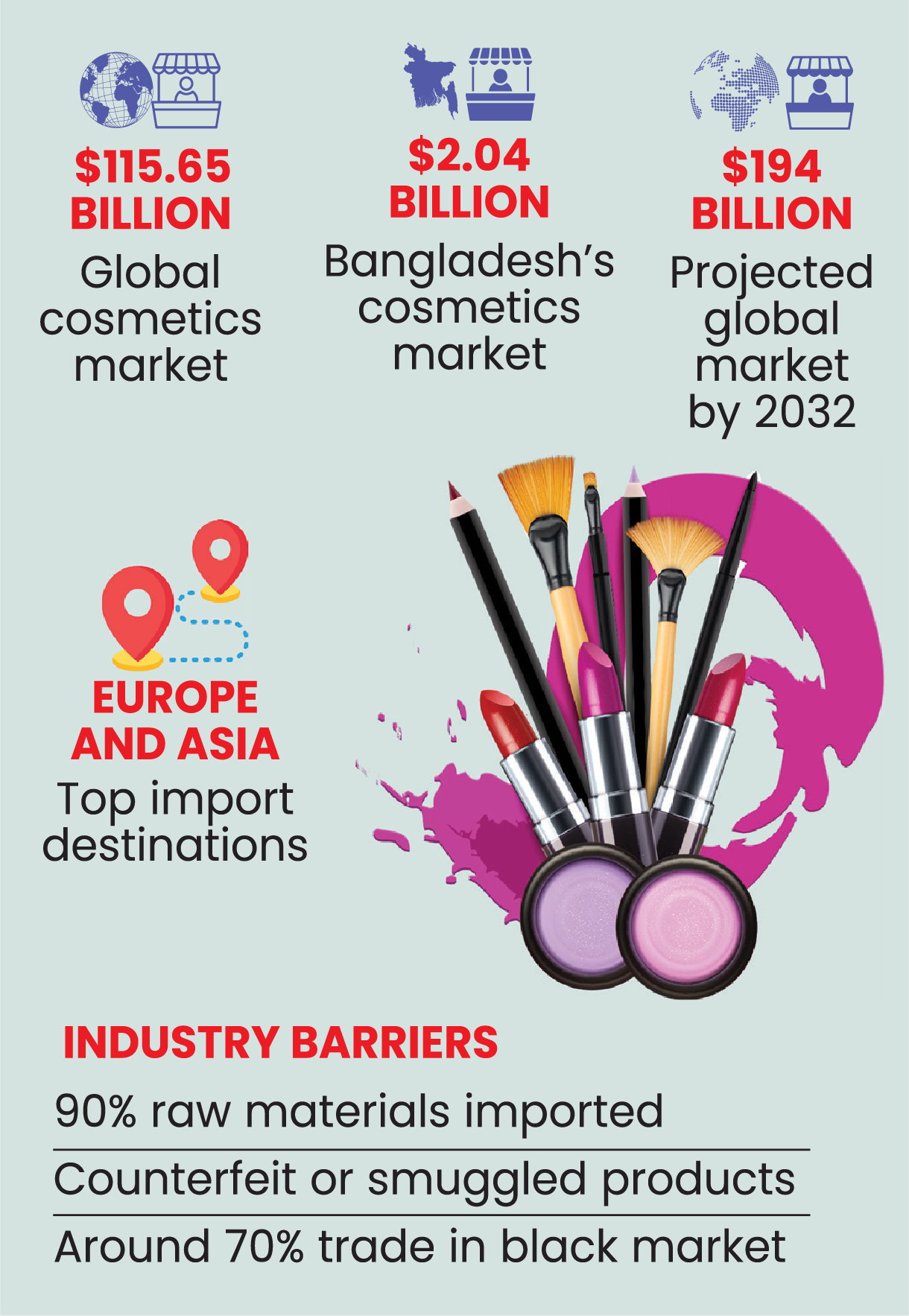

Although there is no concrete data available, industry insiders estimate that multinational and foreign brands account for about 60% of Bangladesh’s cosmetics and toiletries market, while local brands hold the remaining 40%.

Declining cosmetics import

Data from the National Board of Revenue shows that, in the January-June period of 2024, Bangladesh imported 2,138 tonnes of cosmetics, valued at around Tk 150 billion.

In the corresponding period in 2025, imports declined sharply to 1,562 tonnes, valued at Tk 1.11 billion, representing a 27% decrease in volume and a 26% decrease in value.

Domestic brands are catering to local preferences, cultural sensibilities, and particular skin types. The country’s burgeoning middle and lower-middle-income groups have been pivotal to the industry’s evolution.

Skincare, hair-care, and personal hygiene products, once considered prestige items, are now priced to be accessible and relevant, replacing the notion that imported ones are superior.

Opportunity for local brands

Unlike foreign multinationals, local producers understand Bangladeshi consumers’ needs better, whether it is skincare suited to warm, humid climates or formulations that counteract variations in water quality.

They are doing research into herbal extracts, natural ingredients, and formulations that resonate culturally and environmentally.

Local companies produce skincare, hair-care, and personal hygiene products at affordable prices, offering alternatives to pricier imported goods.

Notable brands currently active in the industry are Square, Keya Cosmetics, Remark HB, ACI, and Aarong.

Almasud Kamal, senior manager at Keya Cosmetics Limited, explained that the popularity of locally manufactured cosmetics has risen consistently since the 1990s, when Aromatic Halal Soap entered the market. Since then, the appetite for locally produced personal care items has grown steadily.

The local cosmetics industry holds vast potential given the sizable domestic market, according to Mr. Kamal.

“Our brands have earned consumer trust over the years, and this loyalty continues to grow,” he added.

In terms of raw materials, Kamal assured that domestic manufacturers use the same essential ingredients as their international counterparts. This ensures solid product quality.

In some cases, he added, local firms even strive to exceed these standards to maintain a competitive edge.

“While global brands invest heavily in building brand value through marketing, local companies focus more on improving product quality to gain consumer trust,” Kamal explained.

Nonetheless, challenges remain. The rising cost of raw materials in the international market, up nearly 20% over the past year, has put pressure on production.

However, companies have largely refrained from increasing retail prices, prioritising affordability for consumers.

Although export volumes remain modest, Kamal said that Bangladeshi cosmetics are being shipped to India and Bhutan.

According to Allied Market Research, the size of Bangladesh’s cosmetics and toiletries market stood at approximately $1.23 billion in 2020 and is projected to reach $2.12 billion by 2027.

Distribution infrastructure

Jesmin Zaman, head of marketing at Square Toiletries Limited, noted that local manufacturers began prioritising quality and affordability once it became clear that these attributes could sway consumer preferences toward homegrown brands.

“As a company, we have long focused on using natural ingredients and avoiding harmful chemicals. This has played a crucial role in building customer confidence,” she said.

She explained that the organization she works for is identifying gaps in the market, such as cultural nuances and unmet consumer needs, and develops products accordingly.

Efforts are also being directed at maintaining affordable pricing and strengthening distribution networks, she added.

Ms. Zaman highlighted the export potential for products made using locally sourced materials. However, she acknowledged that weak enforcement of existing regulations puts compliant companies at a disadvantage, as they often incur higher production costs.

She also cited the devaluation of the taka against the US dollar, increased fuel prices, and limited access to new gas connections as critical challenges for the sector.

Lack of standard certification

The most significant constraint for the industry’s upward growth trajectory is a lack of product safety and regulatory oversight. A few local products failing to meet international standards can damage the overall good image of the industry.

Experts have called for more stringent monitoring by regulatory bodies such as the Bangladesh Standards and Testing Institution (BSTI). Without quality assurance and transparent labelling, consumers remain vulnerable to adverse effects, including allergic reactions and long-term health consequences.

Bangladesh’s per capita cosmetics consumption currently stands at Tk 2,400. Although lower than that of neighboring countries, the rate of increase is still rapid.

Urban centres currently account for roughly one-third of total consumption, though this distribution is evolving. As rural households become financially well-off from remittance inflows, demand outside urban areas is expected to rise, and this can be a key growth frontier.

Inflation and other issues

Over the past eight months, the prices of essential items, including soap, shampoo, toothpaste, detergent, and toilet cleaners, have surged by between 10% and 27%, primarily driven by increased import costs and the depreciation of the local currency. Taka has depreciated by over 35% against the US dollar since 2022.

Jamal Uddin, executive director of Remark HB – a skincare brand, observed that the establishment of modern, state-of-the-art factories and the adoption of advanced technologies have enhanced the credibility of locally manufactured cosmetics.

“In a market plagued by counterfeit and adulterated products, domestic companies are playing a vital role in ensuring the availability of authentic goods,” he added.

Jamal Uddin believes that with appropriate support, the cosmetics sector could one day rival even the readymade garment industry in scale and export potential.

Remark HB has already made headway in this direction, securing export orders exceeding $2 million at a recent trade fair in Dubai. The company is exporting to markets in the Middle East, Thailand, the Philippines, Sri Lanka, and the United States.

Consumer adaptability

Faria Anjum Nisa, a resident of Dhaka’s Basabo area, said that she now prefers domestic brands due to their affordability and suitability for her skin type.

“I used to rely on imported products, but they were expensive and often unsuitable. I’ve found that many local brands offer better compatibility and are much more budget-friendly,” she remarked.

Similarly, Sheuly Akhter, a resident of Rangpur, told the scribe that after experiencing skin irritation from foreign body lotions, she switched to a local alternative that worked far better.

“It comes down to what suits your skin, and the local option is easier on the wallet,” she said.

Jamal Uddin, who also serves as the general secretary of the Association of Skin Care and Beauty Products Manufacturers and Exporters of Bangladesh, estimates that the domestic cosmetics market is worth approximately Tk 210 billion and is growing rapidly.

However, the industry faces a host of persistent challenges, including the proliferation of counterfeit and substandard products, false labelling of imported goods, duty-free imports via informal channels, and inadequate government oversight.

While many countries require certification for imported cosmetics, regulations in Bangladesh are either lax or inconsistently enforced, noted Mr. Jamal.

This regulatory imbalance tends to favour importers over local manufacturers, making it difficult for domestic firms to compete on equal footing, he added.

He stated that relevant government bodies are actively engaging with industry stakeholders to address these challenges and are formulating supportive policies.

The greatest asset of Bangladesh’s cosmetics sector, according to Mr. Jamal, is its export potential.

“Locally manufactured products are now eligible for international markets, where demand for high-quality cosmetics, particularly halal-certified goods, is increasing.”

Markets across the Middle East and other regions are showing strong interest in such products, he added.

To remain globally competitive, the sector needs greater investment in product formulation and research.

Bangladesh’s lower production costs, compared with those in Western economies, position the country as a strong candidate for large-scale exports.

“With the right backing, this sector has the capacity to make a major contribution to the national economy,” Mr. Jamal remarked.

Sukanta Halder is a staff correspondent of a national daily, covering insurance, agriculture, commodity markets, the private sector, and consumers.

Most Read

Electronic Health Records: Journey towards health 2.0

Making an investment-friendly Bangladesh

Understanding the model for success for economic zones

Bangladesh facing a strategic test

Bangladesh’s case for metallurgical expansion

How a quiet sector moves nations

A raw material heaven missing the export train

Automation can transform Bangladesh’s health sector

A call for a new age of AI and computing

You May Also Like