Agent banking loans reach BDT 350 Billion

BY Insider Desk

February 16, 2026

Lending through agent banking in Bangladesh rose to BDT 350.23 billion by December 2025, according to Bangladesh Bank data.

Loans increased 9.75 percent in October–December 2025 from the previous quarter, up from BDT 319.10 billion in September. Rural borrowers received BDT 224.28 billion, or 64 percent of total agent banking loans. Female-owned outlets disbursed BDT 24.42 billion, representing 6.97 percent of total loans.

Deposits through agent banking also grew, reaching BDT 497.20 billion by December, up from BDT 477 billion in September. Rural deposits rose 4.02 percent, while urban deposits increased 5.28 percent. Male deposits grew 4.21 percent; female deposits rose 3.24 percent.

Inward remittances through agent banking exceeded BDT 2 trillion, a 6.02 percent increase from the previous quarter. Rural areas received 90.06 percent of total remittances.

The top five banks operated 74.81 percent of agent outlets nationwide. Dutch-Bangla Bank PLC led with 5,631 outlets (27.47 percent) and 7,844,166 accounts (30.36 percent) under the agent banking system

Most Read

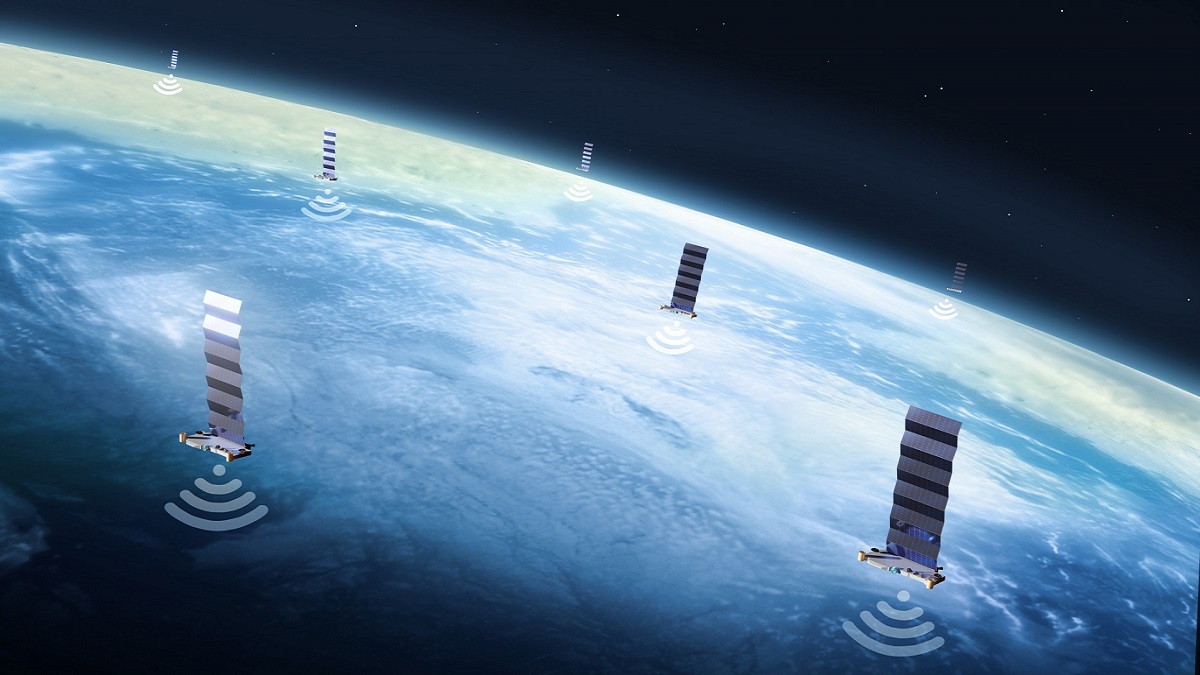

Starlink, satellites, and the internet

BY Sudipto Roy

August 08, 2025

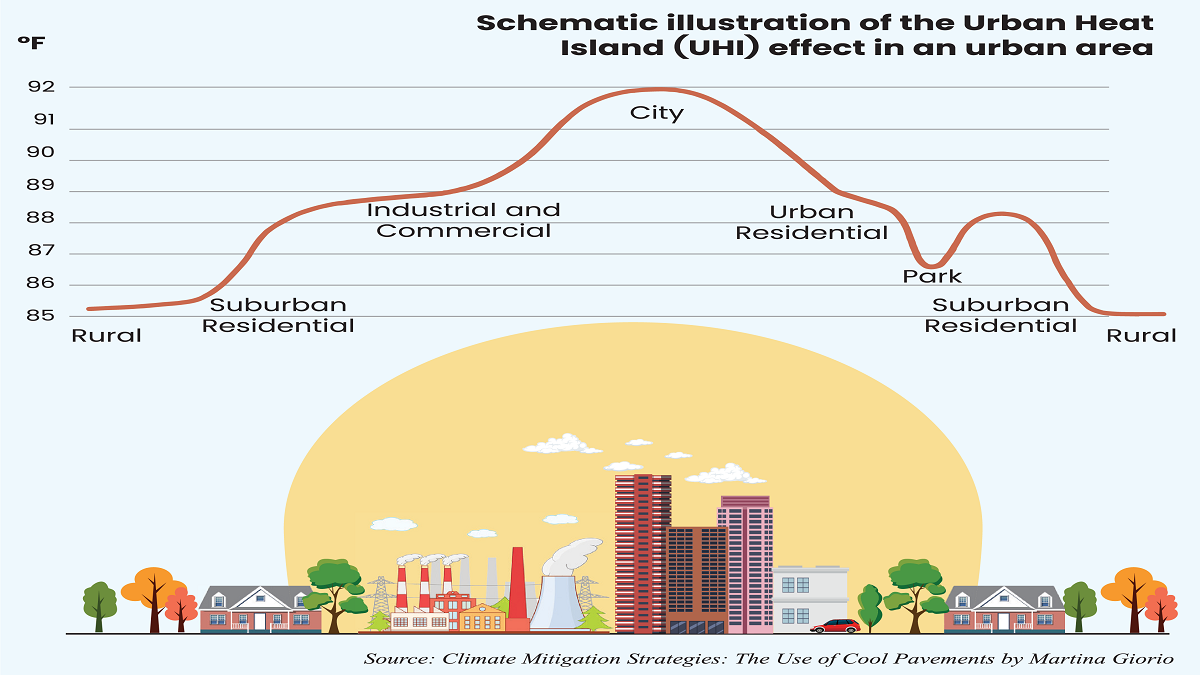

What lack of vision and sustainable planning can do to a city

A nation in decline

From deadly black smog to clear blue sky

Understanding the model for success for economic zones

How AI is fast-tracking biotech breakthroughs

Environmental disclosure reshaping business norms

Case study: The Canadian model of government-funded healthcare

A city of concrete, asphalt and glass

Does a tourism ban work?

You May Also Like