Interest income hit cuts Jamuna Oil profit

BY Insider Desk

January 27, 2026

Jamuna Oil Company’s profit fell sharply in the second quarter of fiscal year 2026 as interest income from bank deposits dried up.

The state-owned firm reported a net profit of 691 million taka for the October to December quarter. This was a drop of 51 percent from the same period a year earlier.

The decline was linked to unpaid interest on deposits held with newly merged Islamic banks. Jamuna Oil holds fixed deposit receipts worth 10.66 billion taka in four banks that were merged into Sammilito Islami Bank to address a liquidity crisis.

The company said in its earnings note that Sammilito Islami Bank was unable to pay interest due to liquidity shortages. Interest income for the second quarter was not accrued. Interest booked earlier was also written back.

Jamuna Oil’s revenue from petroleum sales remained almost unchanged during the quarter. Non-operating income fell 56 percent to 970 million taka.

The company has relied on interest income in recent years. In fiscal year 2025, it posted a record profit of 6.48 billion taka. About 81 percent of that profit came from bank deposits.

Half-year profit for July to December also fell 18 percent to 2.17 billion taka.

Jamuna Oil has sought encashment of its deposits. The banks have yet to respond positively.

Shares of Jamuna Oil fell 1.64 percent on Monday.

Most Read

Starlink, satellites, and the internet

How AI is fast-tracking biotech breakthroughs

From deadly black smog to clear blue sky

Understanding the model for success for economic zones

What lack of vision and sustainable planning can do to a city

A nation in decline

Case study: The Canadian model of government-funded healthcare

Does a tourism ban work?

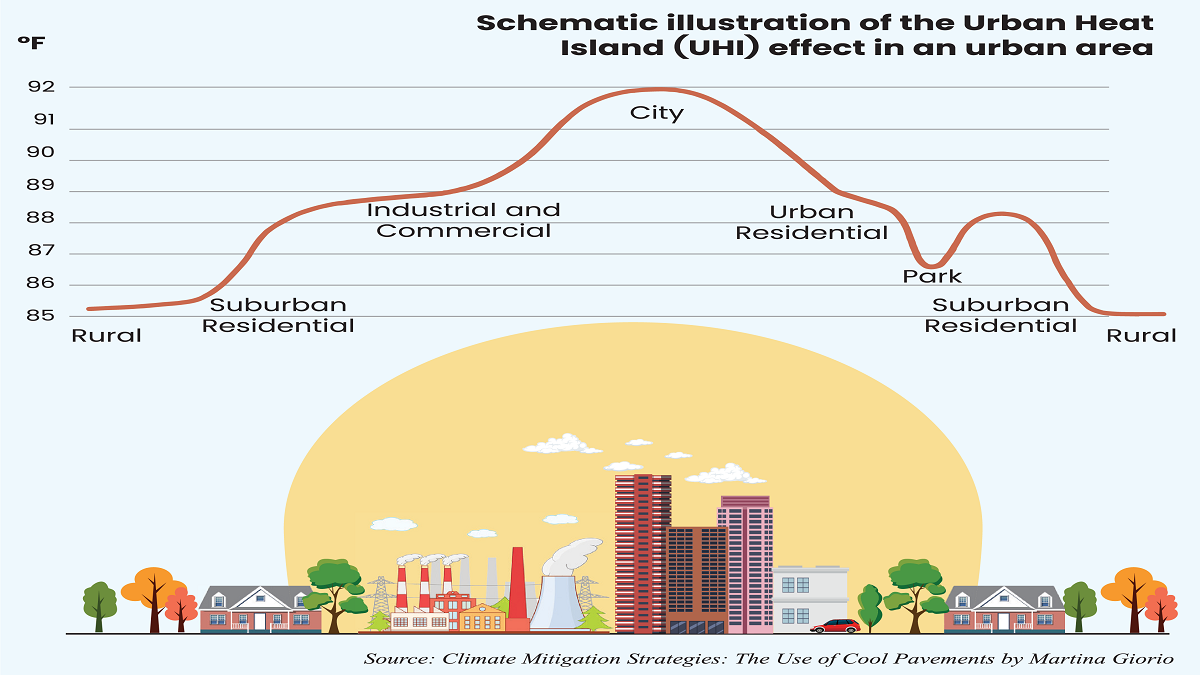

A city of concrete, asphalt and glass

You May Also Like