Study says shifting to direct taxes could cut poverty

BY Insider Desk

November 20, 2025

Bangladesh could significantly reduce poverty and narrow income inequality by shifting from indirect to direct taxation, according to a new study unveiled.

Indirect taxes currently account for 67 per cent of the country’s annual tax revenue, placing a disproportionate burden on poorer households.

The analysis estimates that balancing direct and indirect taxes equally would reduce the national poverty rate from 18.7 per cent to 17.7 per cent. The impact would be most substantial among the poorest: poverty among the lowest-income group could fall from 37.2 per cent to 33.2 per cent, while the next-poorest group would also see a notable improvement. The study was presented at a Dhaka event organised by the OHCHR Mission in Bangladesh.

Author and OHCHR consultant Md Salay Mostofa said a more progressive tax system would also help narrow inequality. The income Gini coefficient falls from 0.4999 to 0.490 under such reforms, while consumption inequality declines modestly.

He added that raising the tax-to-GDP ratio by two percentage points could increase the national employment rate by about one percentage point, with the largest gains in services.

Mostofa warned that Bangladesh’s tax potential remains underused, noting that the country ranks among the lowest globally in tax effort. He argued that heavy reliance on indirect taxes undermines the economic rights of low-income groups.

NBR Chairman Md Abdur Rahman Khan said expanding the taxpayer base remains a challenge, despite 1.20 crore registered TIN holders. Dhaka University’s Dr Sayema Haque Bidisha called for widening the tax net, introducing property and other non-traditional taxes, and improving digital literacy to strengthen tax fairness.

Tags:

Most Read

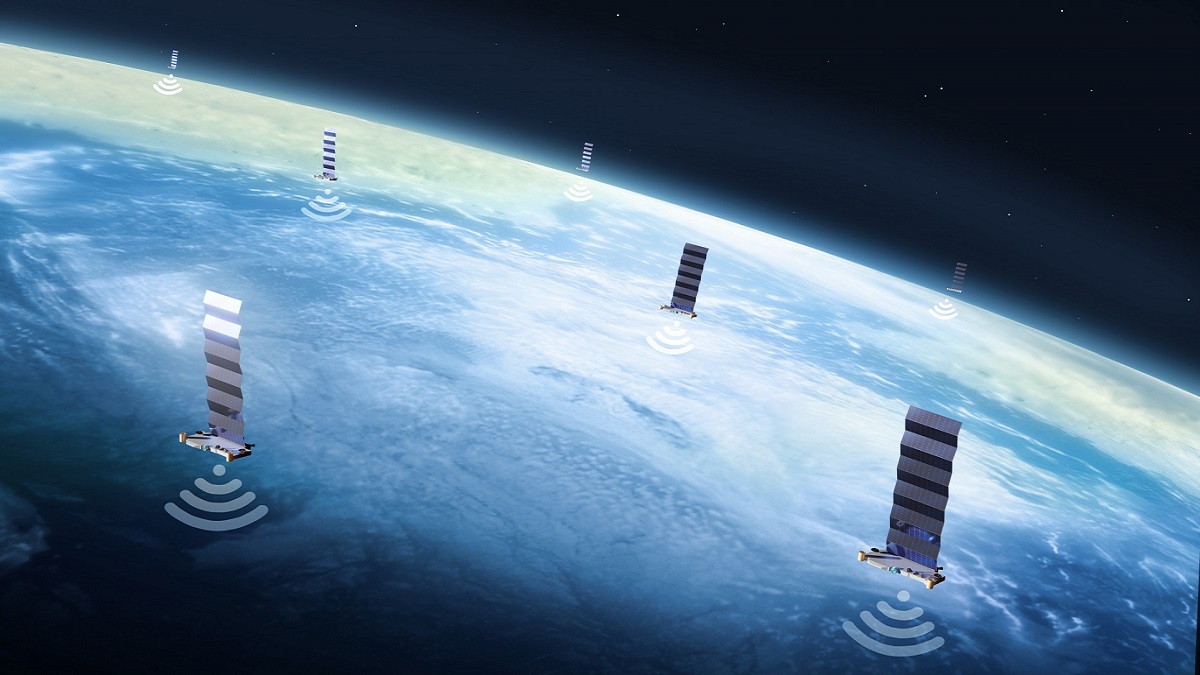

Starlink, satellites, and the internet

BY Sudipto Roy

August 08, 2025

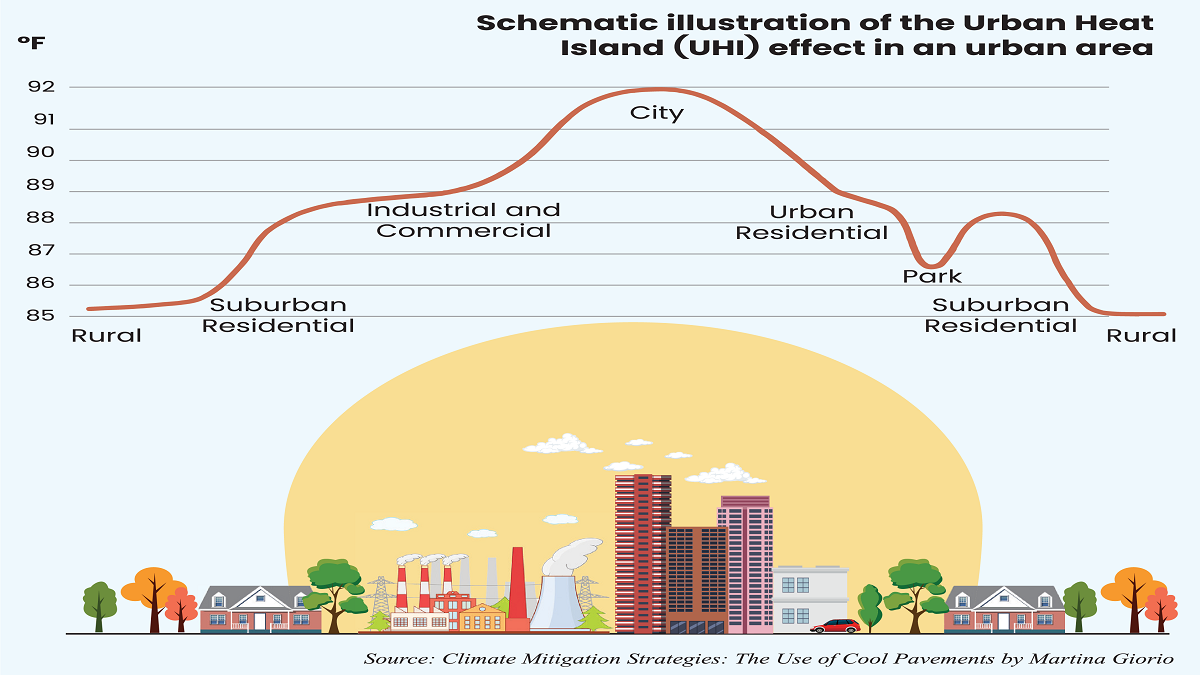

What lack of vision and sustainable planning can do to a city

From deadly black smog to clear blue sky

A nation in decline

Understanding the model for success for economic zones

How AI is fast-tracking biotech breakthroughs

Environmental disclosure reshaping business norms

Case study: The Canadian model of government-funded healthcare

A city of concrete, asphalt and glass

Does a tourism ban work?

You May Also Like