Wealth concentration and the quest for a fairer Bangladesh

February 11, 2026

When people in Bangladesh talk about inequality, the discussion usually begins with wages, prices, and job opportunities. Those are the pressures everyone feels.

But inequality also grows quietly through wealth that moves from one generation to the next. Land, apartments, savings, and business ownership do not just raise living standards for one household. They also shape the affordability of good schools, who can take career risks and who can survive a shock without falling behind.

Over time, this inherited advantage can harden into a system where opportunity depends less on effort and more on family starting points.

This is where the idea of an inheritance tax comes into play. The basic principle is simple. When a person dies, and their assets are transferred to heirs, the state collects a tax from the transfer, usually only above a certain threshold.

In many countries, the aim is not to tax ordinary families but to apply a levy on large estates that can otherwise deepen wealth concentration over decades. The logic is that public policy should support equality of opportunity.

Bangladesh’s baseline matters here. According to a widely used international tax summary, Bangladesh does not have an inheritance tax. It does not automatically mean the country should introduce one. But the topic deserves a clear, practical discussion, especially at a time when concerns about inequality are rising, and social protection reform is on the national agenda.

A significant question is why inheritance tax is necessary at all, given that Bangladesh already has taxes. The answer is that most tax systems rely heavily on consumption and income. Those taxes are important, but they do not directly address the concentration of wealth across generations.

An inheritance tax is one of the few instruments designed specifically for that channel. An IMF article on wealth taxation treats inheritance and estate taxes as one of the main routes for taxing wealth, alongside taxing wealth returns and wealth stocks.

Still, “deserves discussion” is not the same as “ready to implement tomorrow.” Inheritance tax only works if the state can credibly value assets and administer the rules consistently. That is why Bangladesh’s ongoing debate around property valuation is directly relevant.

In the FY2025-26 budget discussion, there has been explicit policy attention to aligning deed values with market values and encouraging registration at real transaction prices, including by adjusting registration-related costs.

These reforms point to a reality that anyone who has bought property understands: if the valuation system is weak, any tax tied to asset values becomes vulnerable to evasion and disputes. An inheritance tax would face the same problem, perhaps more sharply.

Global stories can guide us somewhere. The UK is a classic example of a threshold-based inheritance tax, where official guidance sets out allowances and exemptions, and where the system’s politics revolve around what is taxed and what is protected.

Japan provides clear public guidance from its National Tax Agency on how inheritance tax works and when it applies, demonstrating that administration and clarity are as important as the headline tax rate.

South Korea is in the middle of a reform debate, with reports indicating a move away from taxing the estate as a single unit toward a recipient-based approach that taxes each heir’s share. Switzerland offers a different insight; in 2025, voters rejected a proposal for a high inheritance tax on large estates, highlighting how politically sensitive these taxes can be even in wealthy countries.

A Bangladesh-ready design of inheritance taxation would have to confront a common fear: what about family businesses and households that are asset-rich but cash-poor?

In many countries, the system allows installment payments or defers payment for certain business assets to avoid forcing a fire sale. But these provisions can also become loopholes if eligibility rules are vague or enforcement is weak.

Another argument for placing the inheritance tax on the table is the broader financing challenge. Bangladesh is trying to modernise the delivery of social protection and improve targeting.

In 2025, the World Bank approved financing for reforms that include building a national registry to support better targeting of social programmes. A social registry is not the same as a tax asset registry, but it signifies stronger state capability in identification systems and programme administration. If an inheritance tax is ever to be credible, it must sit within a broader improvement in public administration, data systems, and dispute resolution.

The biggest implementation challenges in Bangladesh are likely to take four forms.

First is valuation. Without a credible valuation of land, real estate, and business assets, the tax will be seen as arbitrary and easy to evade. The second is avoidance. Wealthy households can shift assets, delay disclosure, and exploit legal structures. Third is trust. If citizens believe the system will be applied unevenly, a new tax becomes another source of frustration. Fourth is political feasibility. The referendum result in Switzerland is a reminder that debates over inheritance tax can trigger strong opposition when framed as punitive.

Inheritance tax is not like a magic spell. It will not fix the inherited inequality on its own. But ignoring the role of intergenerational wealth transfer also leaves a major driver of inequality untouched.

Bangladesh does not need to adopt an inheritance tax immediately. It needs to decide whether the topic belongs in serious policy planning. Because inequality that repeats generation after generation is not only an economic issue. It is a question of fairness, opportunity, and the kind of society Bangladesh wants to build.

Most Read

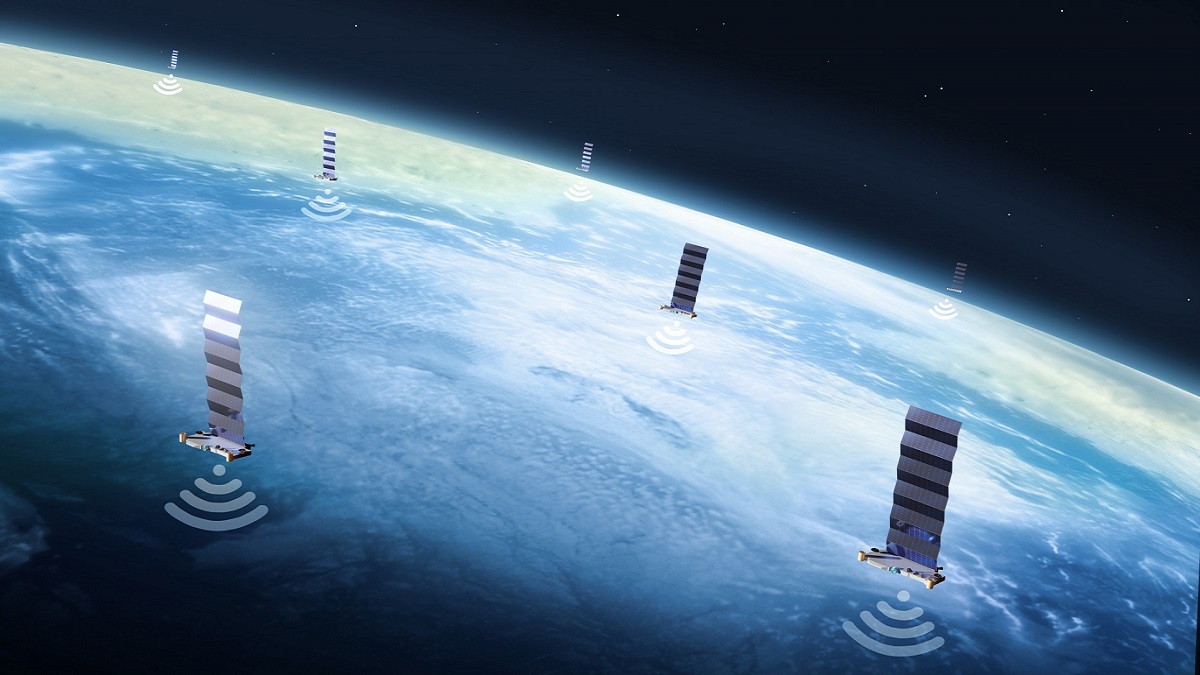

Starlink, satellites, and the internet

BY Sudipto Roy

August 08, 2025

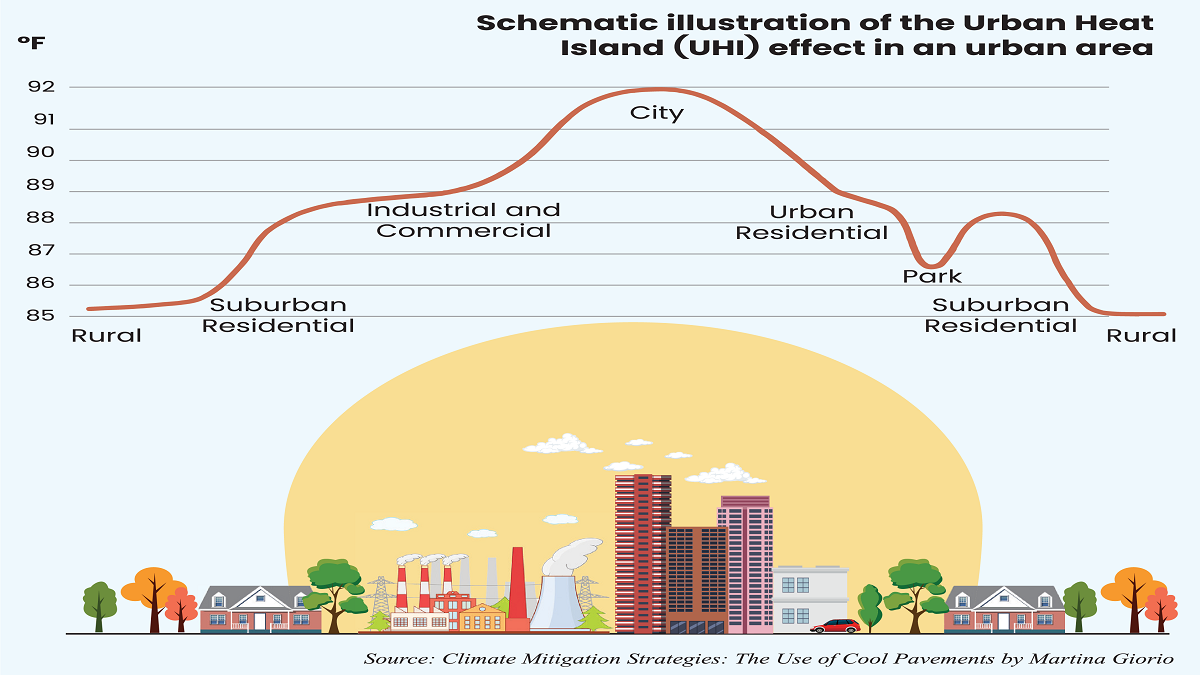

What lack of vision and sustainable planning can do to a city

A nation in decline

From deadly black smog to clear blue sky

Understanding the model for success for economic zones

How AI is fast-tracking biotech breakthroughs

Environmental disclosure reshaping business norms

Case study: The Canadian model of government-funded healthcare

A city of concrete, asphalt and glass

Does a tourism ban work?

You May Also Like