Bangladesh Bank orders tough action to curb soaring default loans

BY Insider Desk

November 13, 2025

Bangladesh Bank has directed commercial banks to take immediate and forceful measures to contain the rapid rise of non-performing loans (NPLs), which the central bank described as a growing threat to the country’s financial stability.

The instruction was issued at a meeting held at the central bank’s headquarters on Wednesday, chaired by Deputy Governor Dr. Md. Kabir Ahmed. Senior executives from commercial banks were told to intensify cash recovery drives and utilise all available policy tools to revive struggling borrowers.

The move follows concerns raised by the International Monetary Fund (IMF) during its ongoing review mission under the $5.5 billion loan programme, after reports showed that default loans in the banking sector had reached alarming levels.

According to officials present at the meeting, the central bank warned that NPLs had surged to over 30% of total loans by the end of September 2025 — a figure that reportedly drew serious concern from the IMF team.

Bank executives said the central bank urged them to cut NPLs “at any cost,” highlighting the liquidity strain created by mandatory reserves for the cash reserve ratio (CRR) and statutory liquidity ratio (SLR).

Several bankers proposed extending the deadline for policy support under BB’s BRPD Circular No. 7, which currently applies to borrowers defaulting by 30 June 2025. They suggested extending the deadline to December to include recently defaulted clients and help stabilise recovery efforts.

Tags:

Most Read

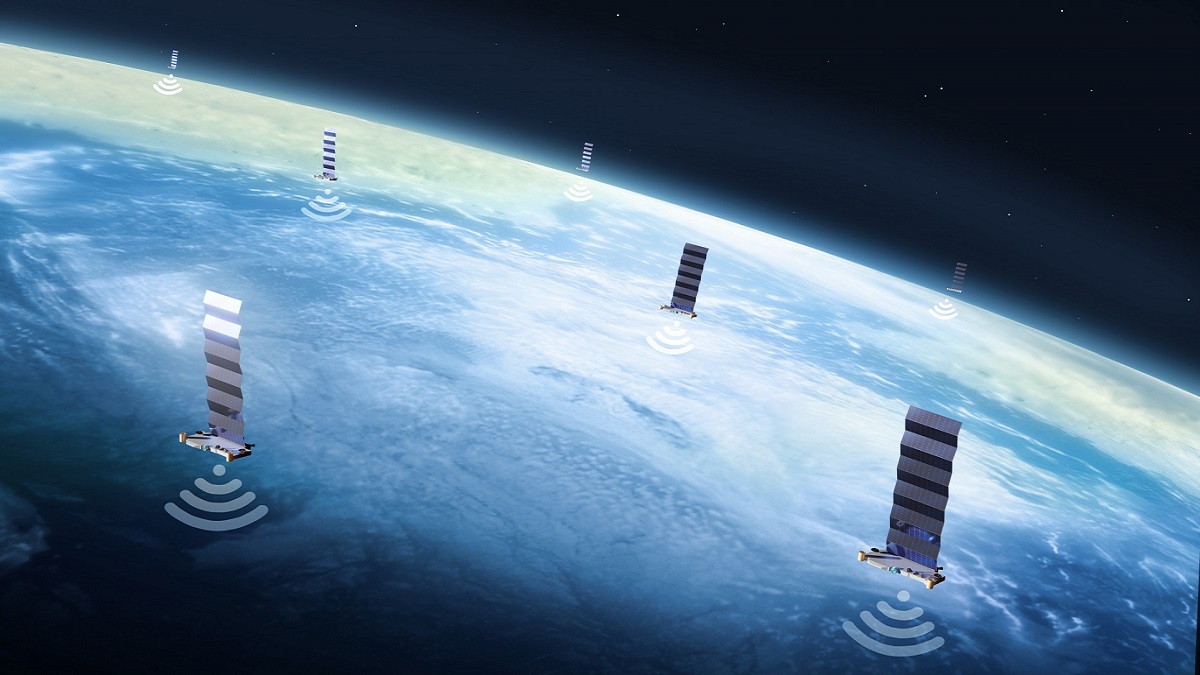

Starlink, satellites, and the internet

BY Sudipto Roy

August 08, 2025

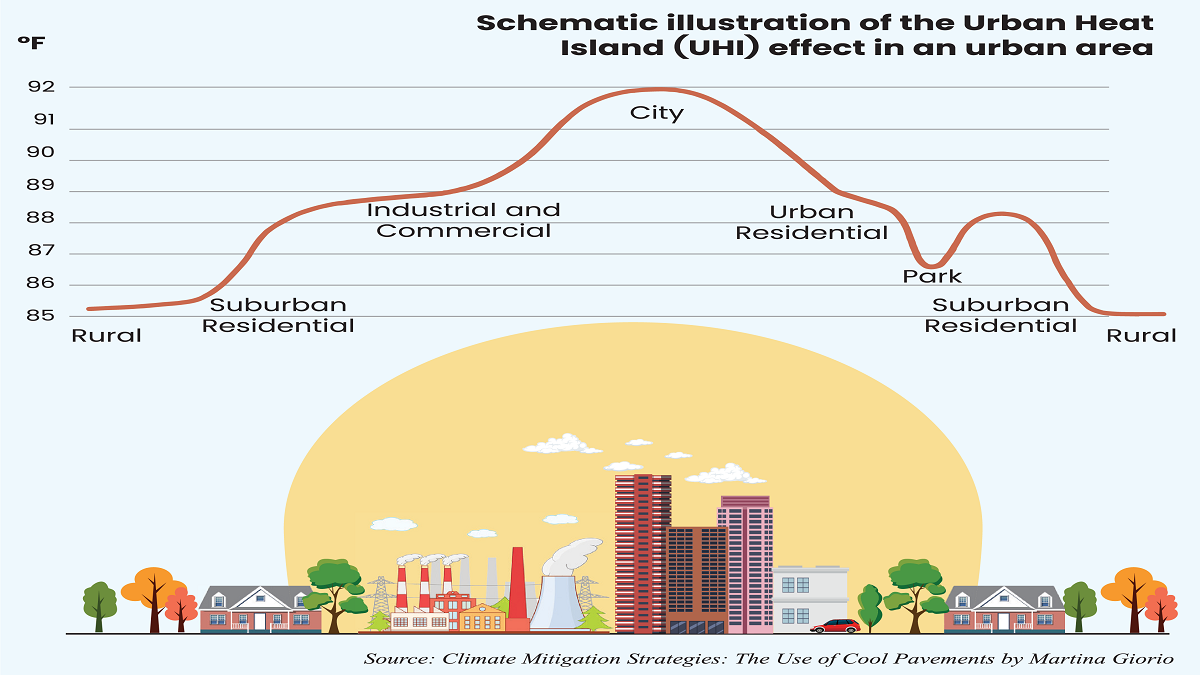

What lack of vision and sustainable planning can do to a city

From deadly black smog to clear blue sky

Understanding the model for success for economic zones

A nation in decline

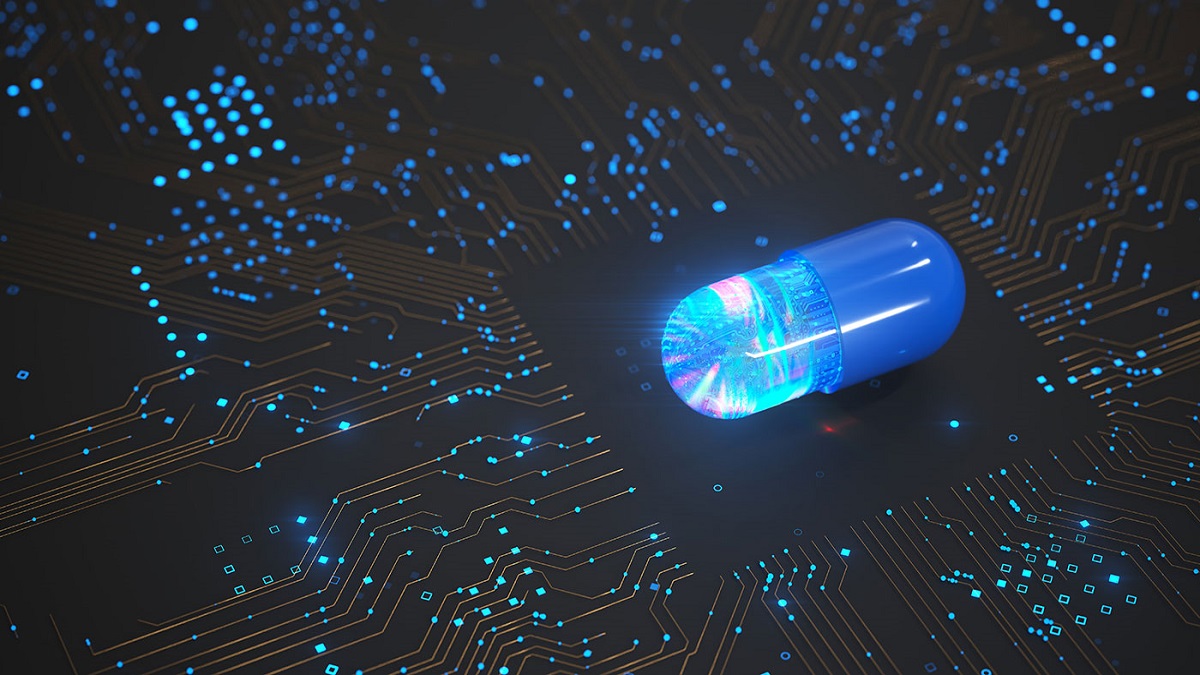

How AI is fast-tracking biotech breakthroughs

Environmental disclosure reshaping business norms

Case study: The Canadian model of government-funded healthcare

A city of concrete, asphalt and glass

Does a tourism ban work?

You May Also Like