Confidence is our biggest currency, coordination is key to revival

November 25, 2025

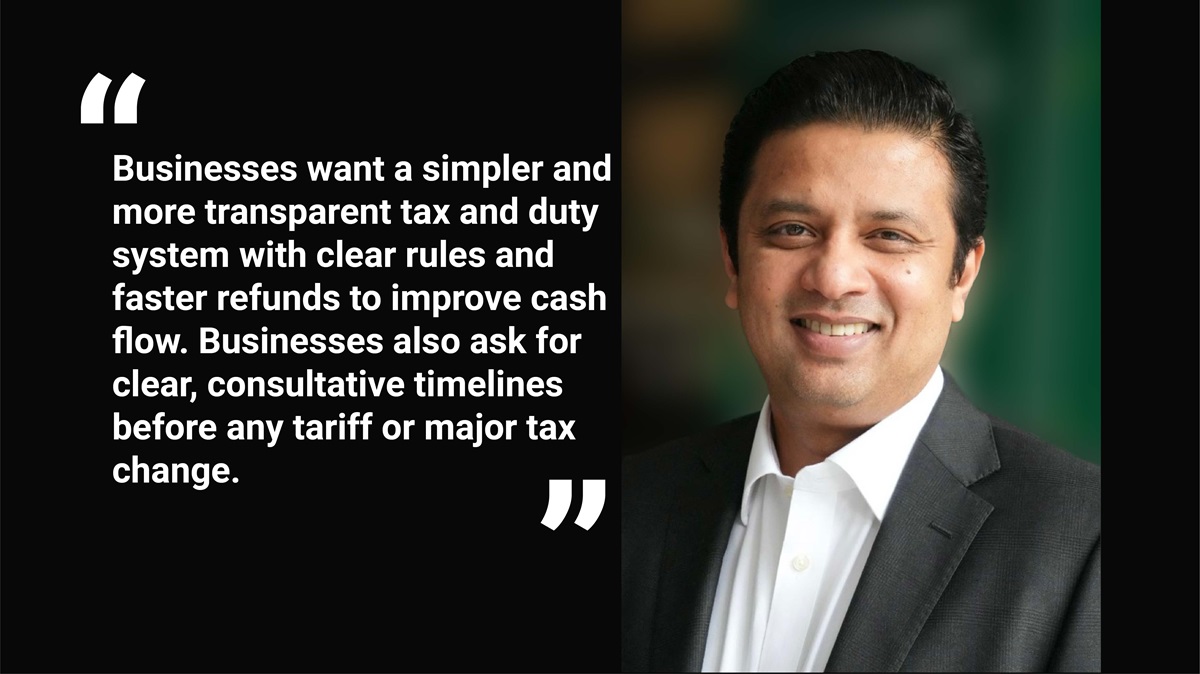

Taskeen Ahmed is the President of the Dhaka Chamber of Commerce and Industry (DCCI). He is a leading voice for the private sector in Bangladesh, advocating for policies on energy, trade, tariffs, and taxation that support industrial growth, competitiveness, and the development of both large enterprises and SMEs. He shares why bringing back business confidence is a top priority.

Which segments of the private sector are suffering the most from the sharp decline in private sector credit growth?

Export-oriented manufacturing (particularly RMG and apparel-related input providers), SMEs that rely on working capital, tech-enabled freelancers/traders are experiencing the most significant blow to the credit slowdown that banks are tightening lending and working-capital lines, and thus production and order fulfillments are limited.

If policymakers were to take urgent steps right now, which single issue should they prioritize to restore private investment?

Reduce policy uncertainty and re-establish predictable liquidity. A focused, temporary reduction in the circumstances of bank lending (refinancing lines to productive sectors and an SME working-capital facility) would not only immediately unblock investment intentions but also restore the predictability of liquidity. Credit scarcity, rather than lack of demand, is the bottleneck, as it has been proven.

How are global shocks-such as the Russia-Ukraine war, supply chain disruptions, and Trump’s reciprocal tariff-affecting Bangladesh’s domestic business climate?

The Russia-Ukraine conflict and worldwide supply interference have increased the expense of inputs and freight and placed inflationary strain; mutual tariffs and escalating protectionism in the foreign markets have made export markets less predictable. Along with the domestic unrest of July 2024 and disruptions of services and shutdowns, supply chains, orders, and buyer confidence have suffered.

On energy insecurity, tariffs, and the tax regime, what are the private sector’s key demands?

Industries need a reliable power and gas supply. Tariffs should cover costs but offer temporary relief to export-oriented and labor-intensive sectors during crises. Businesses want a simpler and more transparent tax and duty system with clear rules and faster refunds to improve cash flow. Businesses also ask for clear, consultative timelines before any tariff or major tax change.

In your view, what joint steps should the government, banks, and businesses take to restore an investment-friendly environment and attract FDI in the private sector, particularly in the aftermath of the July 2024 uprising?

After the unrest of July 2024, confidence is our biggest currency. The government, banks, and businesses must move together. The government should ensure policy predictability, uninterrupted energy supply, and uphold the rule of law.

Banks must make access to finance easier through refinancing and SME-friendly facilities. Businesses, in turn, should present credible, investment-ready projects and strengthen governance standards. A coordinated recovery pact, built on trust and measurable milestones, will restore an investment-friendly climate and draw both domestic and foreign investors back to the country’s economy.

Tags:

Most Read

Understanding the model for success for economic zones

From deadly black smog to clear blue sky

How AI is fast-tracking biotech breakthroughs

Starlink, satellites, and the internet

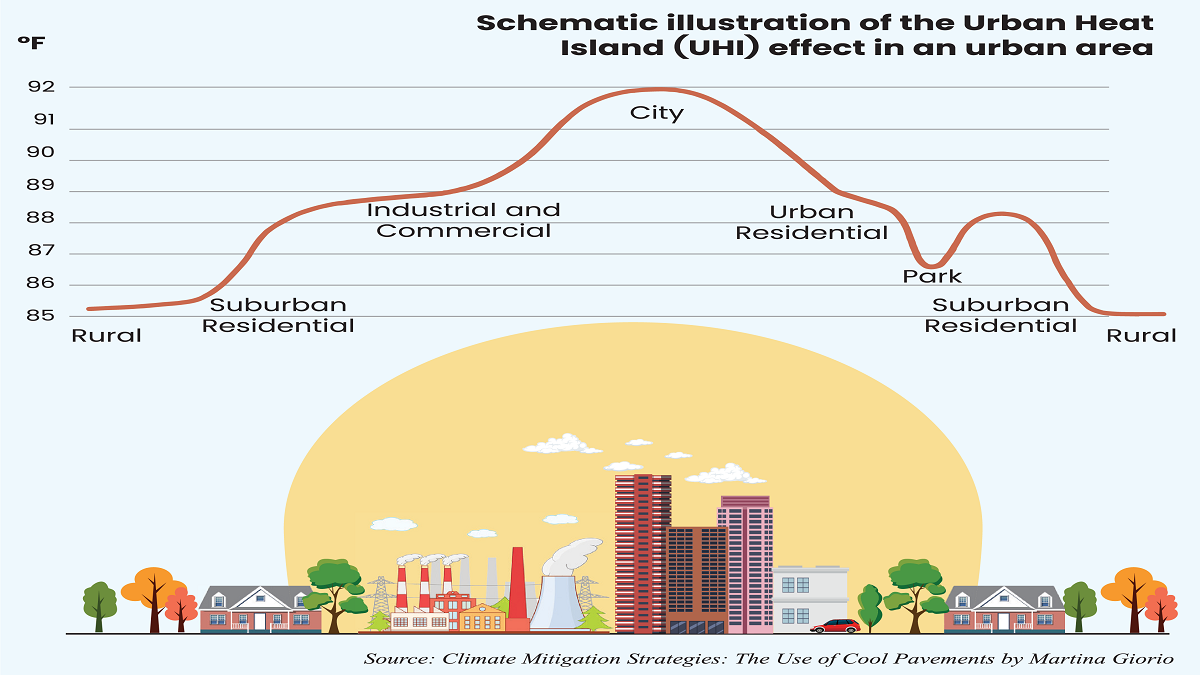

What lack of vision and sustainable planning can do to a city

A nation in decline

Does a tourism ban work?

Case study: The Canadian model of government-funded healthcare

A city of concrete, asphalt and glass

You May Also Like